- The price of gold fell for a third day as the US dollar scale hit a record and Treasury yields rose amid expectations of further monetary tightening by the Federal Reserve.

- This week, the XAU/USD gold price fell below the $1700 level per ounce, down to the $1691 support level. With a temporary halt to the dollar's gains, it has now recovered around the $1,719 per ounce level at the time of writing the analysis.

As global central banks raise interest rates to combat inflation, eroding the attractiveness of non-interest bearing assets.

A deluge of corporate debt offerings and a stronger-than-expected gauge of service sector activity saw Treasury yields advance on Tuesday. This helped support the greenback against nearly all of its major developed market peers, and also spurred bets on a Fed hike of another 75 basis points.

Investors will also be watching the European Central Bank's policy decision on Thursday. Financial markets have scaled back expectations of a rate hike amid growing concerns about the health of the region's economy.

Yesterday the Fed said in its Big Book report, which is usually published two weeks before each policy meeting: “The outlook for future economic growth remained generally weak, with contacts citing expectations of a further decline in demand over the next six to twelve months.” The report showed that price levels "remained very high", but nine regions reported a certain degree of moderation in their rate of increase. Prices of food, rent, utilities, and guest services rose significantly in all twelve federal districts.

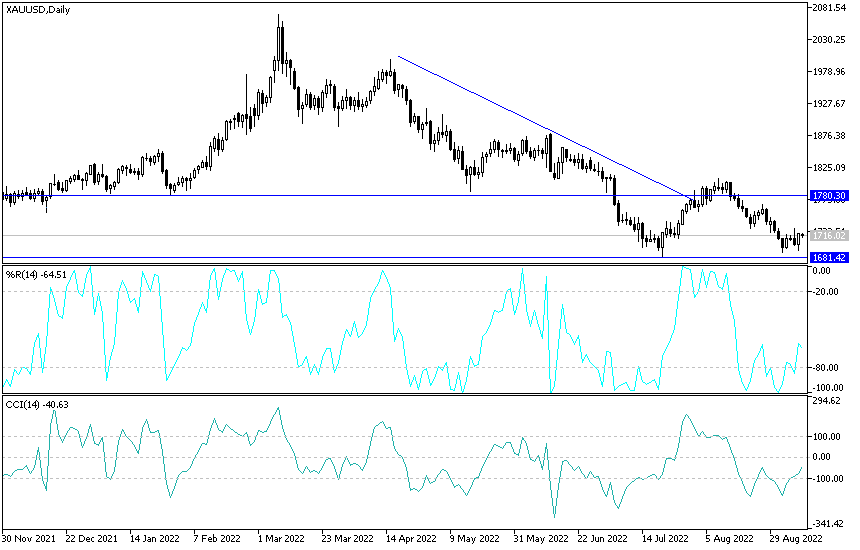

XAU/USD Gold Price Forecast Today:

So far, the general trend of XAU/USD is still bearish and there will be no real chance to break the current trend without breaching the psychological resistance of $1800 an ounce. The return of the bears in the price of gold to the vicinity of the support 1700 dollars, may give a good opportunity to decline strongly again. I still prefer buying gold from every descending level, and the closest support levels for gold are currently 1705 dollars, 1678 and 1660 dollars, respectively. The price of gold today will be affected by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the European Central Bank's policy update.

Ready to trade our Gold prediction today? Here’s a list of some of the best XAU/USD brokers to check out.