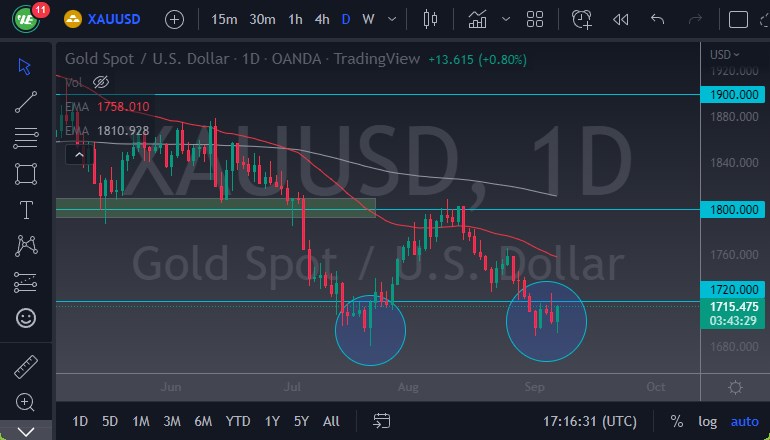

- Gold markets continue to be very volatile, initially dipping during the trading session on Wednesday only to turn around and show signs of life again.

- The $1720 level is being threatened, and if we can break above the $1725 level, it’s possible that gold could have a bit of a recovery for a longer-term move.

- After all, you can make an argument for a “double bottom”, and you can see that could be a major turnaround based on the fact that just below the previous noise that we have seen, there has been a longer-term support level.

As long as we stay above the $1680 level, then it’s possible that we could see the market turnaround, at least for a short-term move. All things being equal, gold will probably continue to see a lot of interest, but that does not necessarily mean that we are going to rally right away and continue to shoot straight up in the air. I think this is a market that continues to be very noisy, but dips may offer buying opportunities. This will be especially true if the interest rates in America start to pull back of it.

Gold Could Benefit from Overbought Dollar

If we were to break down below the $1680 level, then it’s likely that the market could break down rather significantly, perhaps reaching down to the $1500 level. The $1500 level is an area that would attract a lot of attention, but if we break down below there then it could open up the floodgates. I don’t necessarily think that’s going to be the case, but ultimately this is a market that will eventually find its footing, but rates are working against it right now. When you look at this chart, you should also keep in mind that sooner or later people will start to look at this as a potential safety play, and that of course in and of itself will have people looking at it.

Despite what you may have been told, both gold and the US dollar can rally at the same time in the right environment. Whether or not this is the right environment at the moment remains to be seen, but it certainly is an environment that is going to cause a lot of trouble going forward, so we may see both attract a lot of attention. In the short-term, US dollar is overbought so that might be reason enough for a short rally.

Ready to trade our Gold prediction today? Here’s a list of some of the best XAU/USD brokers to check out.