Gold futures fell again last Friday as the rise of the US dollar weighed on the price of the metal.

- Gold prices have been in a downward spiral since it topped $1800 last month.

- The yellow metal failed to benefit from inflationary pressures, mainly due to higher interest rates.

- The price of XAU/USD gold fell to the support level of $1654 an ounce, which increased some speculation about the future of the support level of $1600 an ounce.

After the recent selling, the XAU/USD gold price incurred a weekly loss of about 3.2%, in addition to its decline since the start of the year 2022 to date by about 9%. Additionally, prices of silver, the sister commodity to gold, struggled to hold on to gains earlier in the week. Silver futures fell to $19.055 an ounce. The white metal will post a weekly gain of about 1.4%.

How does USD strength impact Gold?

The strength of the US dollar was the main reason for the decline in metal commodity prices. The value of the consolidation is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors. The US Dollar Index (DXY) rose 0.33% to a 20-year high at 110.10, and accordingly, the index, which measures the performance of the US currency against a basket of currencies, recorded a weekly increase of 1%, which increases its rise since the beginning of the year 2022 to date, including 15%.

The US Treasury market was mixed, with the 10-year bond yield rising 1.2 basis points to 3.471%. One-year yields rose 3.2 basis points to 4.026%, while 30-year yields jumped 2.7 basis points. The spread indicating a recession between two-year and 10-year returns has widened to -43 basis points. Gold is sensitive to a higher interest rate environment because it raises the opportunity cost of holding non-return bullion.

In other metals markets, copper futures fell to $3.47 a pound. Platinum futures fell to $887.60 an ounce. Palladium futures fell to $2,096.00 an ounce.

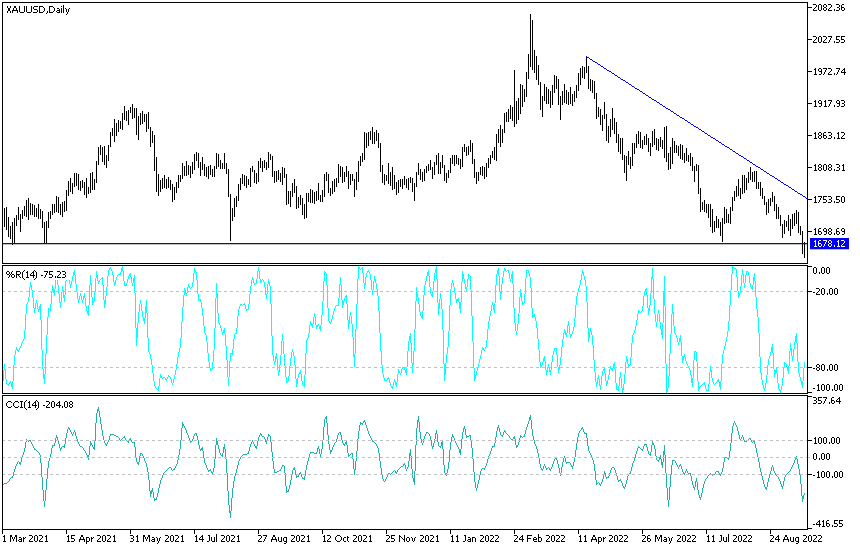

Technical analysis of gold prices:

In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will be looking to push the current gains towards $1,686 or higher to $1,697. On the other hand, the bears will target potential pullbacks around $1,664 or lower at $1,652.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current range of declines towards $1,622 or lower to $1,573. On the other hand, bulls will target long-term profits at around $1,731 or higher at $1,781 an ounce.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.