- At the end of last week's trading, gold prices rose XAU/USD, as the US dollar retreated from the highest level in 20 years.

- The US dollar index fell to the lowest level at 108.36 in the Asian session on Friday, and despite recovering somewhat well, it continues to decline in negative territory at 108.90.

- Accordingly. the XAU/USD gold price rose to the level of 1730 dollars an ounce before this week's trading starts stable around the $1,717 level per ounce.

The US dollar sell-off came after Federal Reserve Chairman Jerome Powell delivered an uncharacteristically strong message last Thursday about how the Fed plans to combat entrenched inflation, and it is now almost certain that the US interest rate will rise by 75 basis points at the Fed meeting.from 20 to 21 September.

The European Central Bank (ECB) raised interest rates by a record 75 basis points last Thursday and signaled further increases to tame hyperinflation. In this regard, Governing Council member Claes Knott said that the European Central Bank should raise interest rates further to prevent record inflation in the euro area from shifting to wages.

Separately, Slovakian President Peter Casimir called for "resolute hikes" to confront "painfully" high inflation.

A report issued by the Department of Commerce showed that wholesale inventories in the United States increased less than expected in the month of July. The report showed wholesale inventories rose 0.6% in July after rising 1.8% in June. Economists had expected wholesale inventories to rise 0.8%. The less-than-expected advance came in wholesale inventories as a 1% jump in durable goods inventories was partially offset by a 0.1% decline in non-durable goods inventories.

Meanwhile, the Commerce Department said wholesale sales fell 1.4% in July after jumping 1.6% in June. This week, the release of US inflation figures will be monitored through the data of the Consumer Price Index and the Producer Price Index.

Inflation Rate too High for Fed

In general, the inflation rate in the United States of America has fallen recently but is still too high for the Fed and with companies ignoring its concerns for a long time when setting rates, it appears that the bank is now trying to reach its “Feddie Krueger” mask, so there may be some dangers of fear of Volcker Night for global markets on September 21. Recent declines in US inflation have been notable, but a week of comments and insights from Fed officials made it clear to analysts at least, that those rate drops were likely too little, too late for US rate-setters.

Commodity prices have skyrocketed in the past year, driving up inflation margins and corporate profits, but by indulging in this price gouging and reckless consumption, it now appears that businesses and consumers may have called themselves something like the Volckerian interest rate experiment. Paul Volcker was the Fed chair best known for using brutally high interest rates to drive double-digit inflation out of the US economy between 1979 and 1989: a turbulent period for global markets.

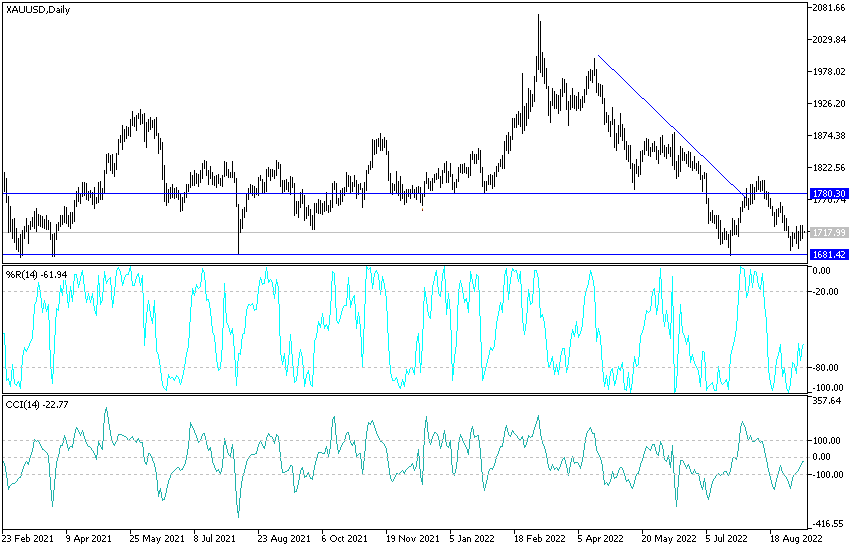

Technical analysis of gold prices:

In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will target short-term rebound profits around $1,725 or higher at the $1,735 resistance. On the other hand, the bears will look to pounce on extended pullbacks around $1,709 or lower at $1,700 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of the yellow metal XAU/USD is trading within a descending channel formation. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current series of declines towards $1,680 or lower to $1,638 an ounce. On the other hand, the bulls will look to pounce on profits at around $1,761 or higher at $1,800 an ounce.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.