Yesterday the price of gold rose with the decline of the US dollar and expectations of inflation on the background of rising energy costs, which exceeded the expectations of the European Central Bank to raise the interest rate. XAU/USD gold prices settled upwards towards the resistance level of $1726 an ounce, but after returning from the American holiday, investors increased their appetite to buy the US dollar again. Accordingly, the price of gold moved downward again and settled around the support level of $1692 an ounce at the time of writing the analysis.

- The US currency is still the strongest with expectations of a US interest rate hike.

- Gold prices attempted to recover after a five-month halt of declines through August as the US dollar and 10-year Treasury yields rose.

- It is weighing on the non-interest-bearing precious metals market.

- Gold is also finding support as a traditional hedge against price pressures.

Global central banks are raising interest rates to fight inflation, with expectations growing for the European Central Bank to raise 75 basis points in its next policy decision on Thursday. Meanwhile, the People's Bank of China moved in the opposite direction, recently cutting its key rate by 10 basis points.

On Monday, China said it was "very important" for the country to adopt supportive policies this quarter as it tries to recover from losses linked to the epidemic. The People's Bank of China (PBOC) also cut the amount of foreign currency deposits that banks need to put aside as reserves for the second time this year in a bid to boost the yuan after the currency hit a two-year low.

Gold is expected to resume its upward trend

European ministers will discuss on Friday special measures to rein in high energy costs, from capping gas prices to suspending the trading of energy derivatives, as the bloc races to respond to a deepening crisis. Separately, OPEC+ agreed to cut 100,000 barrels per day in October.

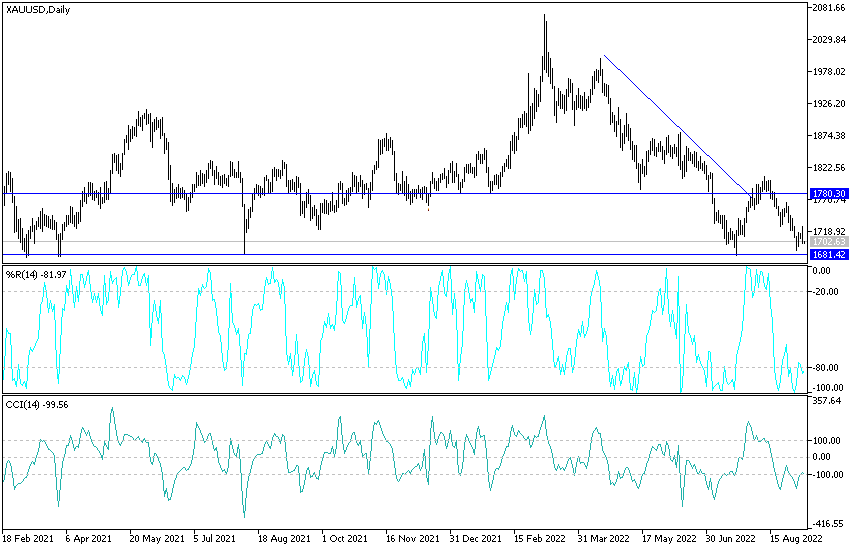

XAU/USD Gold Price Forecast Today:

On the daily chart, the XAU/USD gold price broke the support level of 1700 dollars. This is indicating that the bears may move towards stronger support levels until the technical indicators test oversold levels.

The strongest support levels for the gold price may be at the moment 1685 and 1660 dollars, respectively. From the last level, the opportunity to buy is stronger. A strong and continuous reversal of the gold trend will not occur without moving towards the psychological resistance of 1800 dollars again.

The gold price will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the Bank of Canada policy decisions and any global geopolitical tensions.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.