- The price of gold settled above the level of 1700 dollars at the end of trading last exciting week.

- Gold rose to the level of 1718 dollars an ounce, after selling operations in the same week that pushed it towards the support level of 1688 dollars an ounce, its lowest in six weeks.

- The rebound of the gold price came after announcing the mixed results of the US jobs and wages reports by the end of the week.

- After the last performance, price will still incur a weekly loss of around 2.6%, adding to its YTD loss of around 6%.

As for the price of silver, the sister commodity of gold, it topped the $18 mark. Accordingly, the price of the white metal also recorded a weekly decrease of about 6%, which exacerbates its decline since the start of the year 2022 to date by 23%.

Metals prices rose amid the US jobs report for August, which was neither too resilient nor too cold, hitting gold locks territory. According to official figures and according to the Bureau of Labor Statistics (BLS), the US economy added a total of 315,000 new jobs in August, down from 526,000 jobs created in July. The market had expected a reading of 300,000. The country's unemployment rate rose to 3.7% last month, up from 3.5% in July. This was also above market estimates of 3.5%.

The labor force participation rate rose to 62.4%, the average hourly wage rose only 0.3% to $32.36, and the average weekly hours decreased to 34.5. BLS statisticians also cut job gains for June and July by a total of 107,000. Professional and business services (+68000), health care (+48000) and retail (+44000) led job gains in August. Manufacturing increased by 22,000 jobs, financial activities increased by 17,000, and wholesale trade increased by 15,000. Mining added 6000 jobs.

Overall, gold prices also rose on the back of dollar weakness as the US Dollar Index (DXY) fell to 109.40 from an opening at 109.64. A lower price is good for dollar-priced goods because it makes it more expensive for foreign investors to purchase it. Another factor affecting the gold market, The US Treasury market yields were also in the red, with the benchmark 10-year bond yield dropping 4.7 basis points to 3.22%. Yields on one-year notes fell 3.5 basis points, while yields on 30-year notes were flat at 3.368%.

As is well known, gold is sensitive to the rising rates environment because it increases the opportunity cost of holding bullion, which does not yield a return.

Investors welcomed the US jobs report, with the expectation that the US central bank will only pull the trigger on a 50-basis point rate hike at the September FOMC meeting. Looking ahead, interest in gold is very low, says Jeff Wright, CIO at Wolfpack Capital.

“Next week and into September, I will be very focused on any inflation data and hints about the next step after the FOMC likely raises the FOMC by another 75 in mid-September,” he told MarketWatch. “I don't see anything that will change this in the short term as safe haven demand is almost non-existent,” he added.

In other metals markets, copper futures rose to $3.4245 a pound. Platinum futures rose to $820.40 an ounce. Palladium futures advanced to $2,029.50 an ounce.

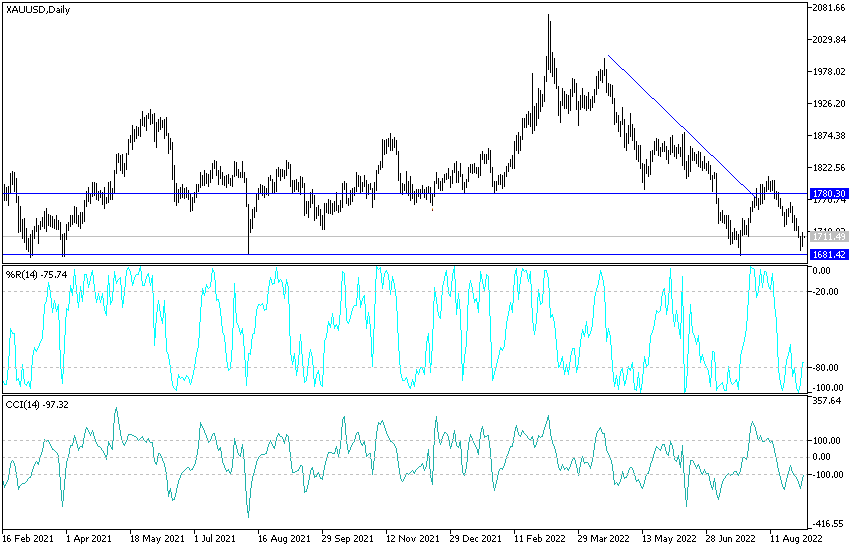

Gold Technical Analysis:

In the near term and according to the performance on the hourly chart, it appears that the price of gold is trading within an ascending channel formation, and this indicates a huge short term bullish momentum in the market sentiment. Therefore, the bulls will look to ride the current gains towards $1,721 or higher to $1,731. On the other hand, the bears will target profits at around $1,703 or lower at $1,692 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of the yellow metal is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears - the bears - will be looking to extend the current lows towards $1,680 or lower to $1,639 an ounce. On the other hand, the bulls will target potential bounces around $1,744 or higher at $1,785 an ounce.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.