- Strict expectations about the future of raising US interest rates still support the US dollar, which is stable around its highest level in 20 years.

- This increases the pace of losses in the XAU/USD gold price, which fell to the support level of 1660 dollars an ounce.

- It is stable until the markets and investors react to the Fed’s announcement US later today.

Reacting to the event, US stocks fell on Tuesday, with the S&P 500 index down more than 1% on the eve of the FOMC's decision. Wild daily market moves have been so common lately that options traders are loading short-term bets at a pace unseen in the post-close era.

Market moving developments

Over the past month, average daily volume in derivatives contracts tied to the largest ETF that tracks the S&P 500 (SPY Index) with a maturity that within one week has risen to the highest level since at least the start of 2020, according to data committed by Susquehanna International Group.

By contrast, trading in long-term contracts has mostly slowed or stagnated. Whether they are directional bets or intended for hedging, it's hard to tell. But the intense focus on the here and now may reflect a lack of conviction in trading longer-dated options at a time when the market is stuck in a range. Add to that all the market-moving developments like last week's shocking inflation data, which is a recipe for traders to shorten their time horizon.

For stock investors, the quasi-dated options pool means that the cash market is most likely hostage to the derivatives market. While the narrative is controversial, Friday's $3.2 trillion options expiration, for example, was seen in some circles as a catalyst that exacerbated the stock sell-off sparked by the hotter-than-expected CPI reading.

Expectations are strong for the Federal Reserve to raise US interest rates by another 75 basis points on Wednesday. With continuing uncertainty about the Federal Reserve's monetary policy and its impact on the US economy, analysts tracked by Bloomberg showed mixed views on the stock market on a scale rarely seen in Date. While the long-term outlook remains murky, stocks have become big business as obsession with economic data or Fed rhetoric overshadows market fundamentals.

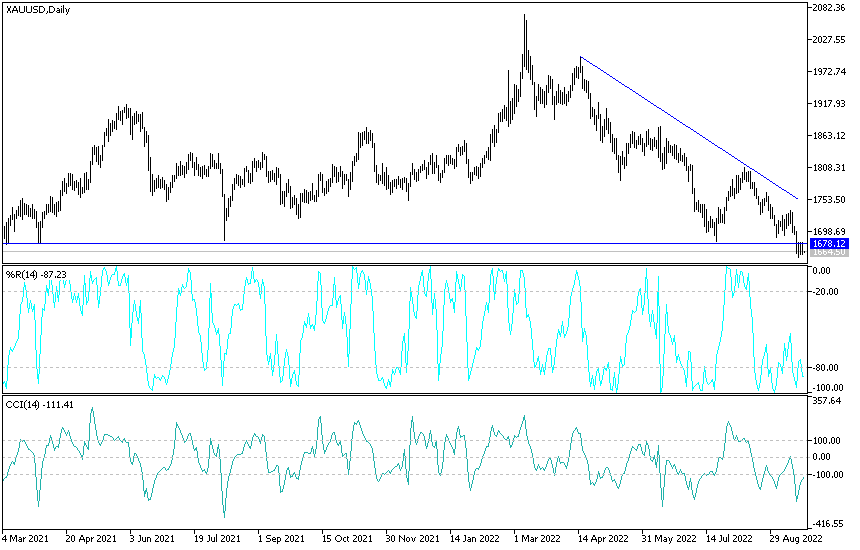

XAU/USD Gold Price Forecast Today:

The direction of the XAU/USD gold price still tends more to the downside as long as it is stable below the support level of $1700 an ounce. The bears’ control over the trend may increase if prices move towards the support levels of 1660 and 1638 dollars, respectively. The last level is important to expect the psychological support level of 1600 dollars, especially if the strength of the US dollar increases.

On the other hand, the return of the stability of the gold price, above the level of 1700 dollars an ounce, may support the bulls to start launching, but with caution, as the US dollar is still strong. The price of gold will be affected today by the level of the US dollar and the extent to which investors are willing to risk or not, and prices may remain in narrow ranges until the reaction from global central banks’ announcements this week, especially the US Federal Reserve.

Ready to trade today’s Gold technical analysis? Here are the best Gold brokers to choose from.