- Gold price was little changed near its weakest level in more than two years as investors weigh the potential size of a looming interest rate hike by the Federal Reserve, which could put renewed pressure on the precious metal.

- Bullion prices, which hovered above $1,700 an ounce in the first half of September, fell below that level last week.

- The price of XAU/USD (gold) has since settled around the $1,675 level at the time of writing the analysis.

- In general, the Fed’s move on Wednesday to raise US interest rates by up to 100 basis points to counter inflation may lead to another slide in the price of the precious metal which is of no interest.

Gold is still "showing resilience" ahead of the Federal Reserve's rate decision, according to Peter Maroney, CEO of Yamana Gold Inc. He saw Asian buyers helping prices, including strong support from countries such as India and China, where gold jewelry purchases were stymied by the Covid-19 outbreak. According to government data, China's total non-monetary gold imports jumped to 182 tons last month, the largest amount since June 2018, from 176 tons in July.

In the longer term, bullion enthusiasts in the Denver Gold Forum are optimistic. Prices will reach $1,806.10 an ounce by the end of the year, according to the average estimate in a survey of 10 participants at the industry's largest annual gathering. The forecast is at 7.8% above Monday's spot closing price, and the last time gold settled at that high was at the beginning of July.

Bullion prices have fallen over the past month in the face of the dollar's relentless gains, and the Federal Reserve's decision to raise interest rates this week will be key to what happens next. A larger-than-expected increase could fuel a stronger dollar and further erode the attractiveness of non-interest assets. Federal Reserve Chairman Jerome Powell and his colleagues are meeting on Tuesday to set US interest rates with expectations of a massive rate hike of 75 basis points. Hot US inflation data last week, along with strong labor market and retail sales numbers, led some to expect a full percentage point increase.

“The heightened geopolitical and economic risks do little to tempt safe-haven buying, as the US dollar remains the preferred asset,” Australia and New Zealand Banking Group analysts in a note.

The price of gold fell to a two-year low last week after falling below a key threshold of $1,700 an ounce. Meanwhile, the European Central Bank is also expected to continue raising interest rates “in October and beyond,” according to Bundesbank President Joachim Nagel.

Gold Forecast

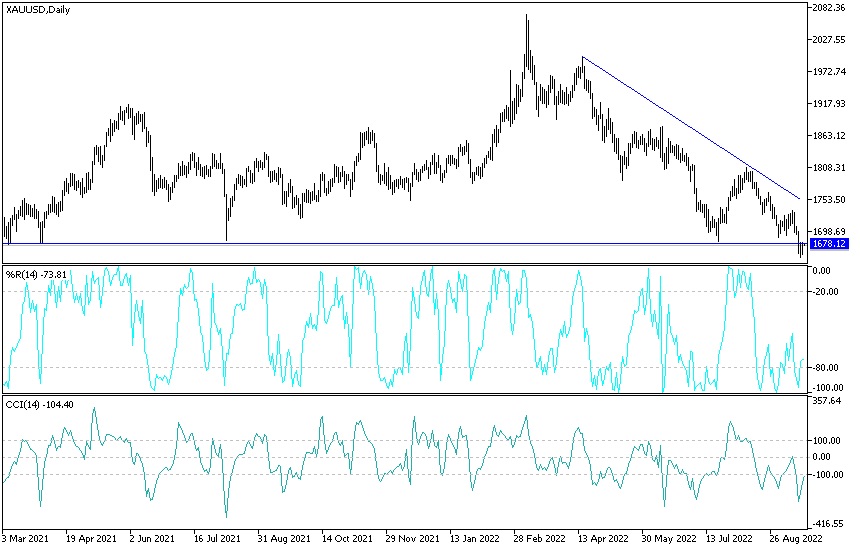

According to the performance on the daily chart, the direction of the XAU/USD (gold) price still tends more to the downside if it is stable below the support level of 1700 dollars an ounce. The bears’ control over the trend may increase if prices move towards the 1660 and 1638 support levels, respectively. It is important to expect the l1600 psychological support level, especially if the strength of the US dollar increases.

On the other hand, the return of the stability of the gold price, above the 1700 an ounce level, may support the bulls to start launching. However, this should do this with caution, as the US dollar is still strong. The price of gold today will be affected by the level of the US dollar and the extent to which investors are willing to risk or not. Prices may remain in narrow ranges until the reaction to global central banks’ announcements this week, especially the US Federal Reserve.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.