The price of gold is heading for the fifth consecutive monthly decline, the longest losing streak in four years, as speeches by Federal Reserve officials indicate that the US central bank will keep monetary policy tight for some time. The price of XAU/USD gold fell to its lowest level in a month at the support level of $ 1710 an ounce and settled around it in the beginning of trading today, Thursday. It is continuing a series of losses since a speech by Federal Reserve Chairman Jerome Powell last week, which stressed the US central bank’s commitment to curbing inflation. All in all, the price of gold is now down more than 6% in 2022, having approached a record high when the Russian invasion of Ukraine increased demand for safe haven assets.

Other officials took a similar hawkish tone. New York Federal Reserve Chairman John Williams said on Tuesday that interest rates may need to advance above 3.5% at some point to contain price pressures. Separately, Richmond Fed President Thomas Barkin said the central bank "will do what it takes" to curb inflation.

Meanwhile, his Atlanta counterpart Rafael Bostic described the duty to curb inflation as "unwavering," but also said he would be open to restarting the pace of increases if prices fell. Officials were ambiguous about the extent of their policy move at the interest rate decision meeting in September. And there are new signs of strength in the US economy, with job openings and a gauge of consumer confidence both above expectations, indicating strong demand for labor and household that risks sustaining inflationary pressures and increases the odds of a 75 basis point straight rate hike.

The ADP Research Institute National Employment Report on Wednesday showed that 132,000 jobs were added in the US in August, well below the average forecast by economists. The data will be taken into account before the government's non-farm payrolls report on Friday.

Fed can turn economy into a recession

Wall Street markets are worried that the Fed could hit the brakes hard on an already slowing economy and turn it into a recession. Higher interest rates also hurt investment prices, especially for higher-priced stocks such as technology companies. Investors are now trying to get a better idea of the extent and speed of the Fed's rate hike, starting with the central bank's next policy meeting on September 2021. The Fed has already raised interest rates four times this year and is expected to raise short-term rates by another 0.75 percentage points at its September meeting, according to CME Group.

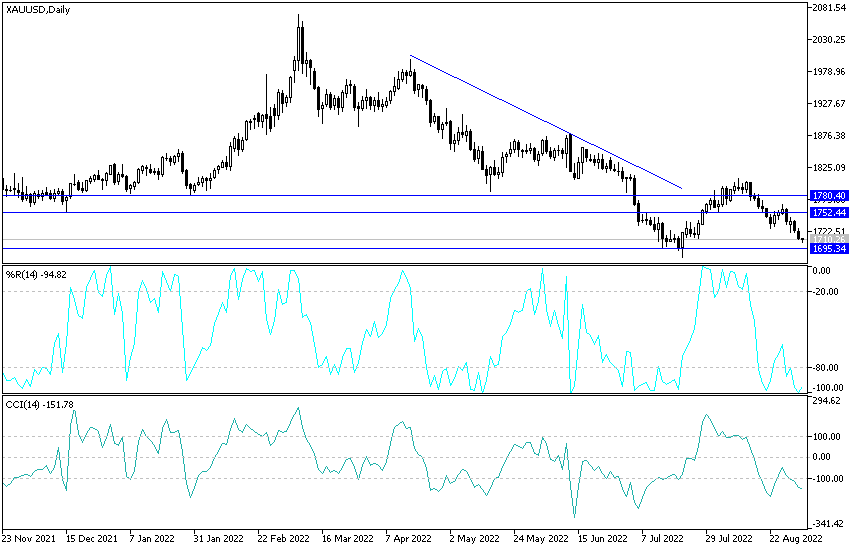

XAU/USD Gold Price Forecast Today:

- The continuation of the strength of the US dollar will be more negative pressure for gold prices XAU/USD.

- It may be possible to break the support level of 1700 dollars.

- The bears’ control stations may be on the trend towards the support levels 1680 and 1658 dollars, respectively, and the last level is ideal for buying.

Gold losses may stop and be an opportunity for a strong upward rebound in the event that the US job numbers fall short of the market’s expectations and negatively affect the path of raising US interest rates.

On the other hand, and as I mentioned before, it will be important to test the psychological resistance of 1800 dollars to change the trend to the upside and for a longer period. I still prefer buying gold from every bearish level. Some technical indicators have already reached oversold levels.

Ready to trade today’s Gold technical analysis? Here are the best Gold brokers to choose from.