For the second day in a row, XAU/USD gold prices fell, and thus pushed the most active gold futures contract to its lowest settlement in nearly two months. The price of gold fell to the support level of 1694 dollars an ounce, which is stable around it in the beginning of trading today, Thursday.

- Prices tumbled from gains at the beginning of the week, reaching the resistance level of 1735 dollars an ounce.

- The strong selling of gold came in the wake of the strong momentum that the dollar gained after announcing the rise in US inflation, contrary to expectations of a decline.

- The US dollar index rose sharply on Tuesday after data from the Labor Department showed that inflation was higher than expected in the US in August.

- Data from the US Labor Department on Tuesday showed that the consumer price index rose 0.1% in August after remaining below change in July. Economists had expected consumer prices to fall 0.1%.

Compared to the same month last year, consumer prices rose 8.3% in August, reflecting a slowdown from the 8.5% rise in July. However, economists had expected the annual growth rate to slow to 8.1%. Meanwhile, annual growth in core consumer prices accelerated to 6.3% in August from 5.9% in July. The annual growth rate was expected to rise to 6.1%.

Weighing Next Policy Steps

Among the latest economic data, the Labor Department said the US producer price index for final demand fell 0.1% in August after declining by a revised 0.4% in July. The report also showed that the annual rate of growth in producer prices slowed to 8.7% in August from 9.8% in July, roughly in line with estimates.

US stocks rebounded in late trading, a day after severe inflation caused the biggest defeat in more than two years. After swinging between gains and losses throughout the day, the lower buyers appeared to send the S&P 500 index into the green at the close. Volume was about 20 percent higher than the 30-day average at that time of day, as investors weighed the Fed's next policy steps.

The benchmark index fell more than 4 percent on Tuesday after a shocking US consumer price figure prompted investors to increase bets on interest rate increases. Those tensions eased on Wednesday after data showed producer prices fell for a second month. Thursday's retail sales and Friday's University of Michigan readings will be analyzed for evidence of the economy's strength and inflation expectations.

Swaps traders are now pricing in a three-quarter percentage point rise when the Fed meets next week, with some bets emerging for a full point move. The two-year Treasury yield, which is most sensitive to policy changes, rose 2 basis points after jumping as much as 22 basis points on Tuesday, pushing it more than 30 basis points above the 10-year rate. This deepened the curve inversion in what is generally considered a recession warning.

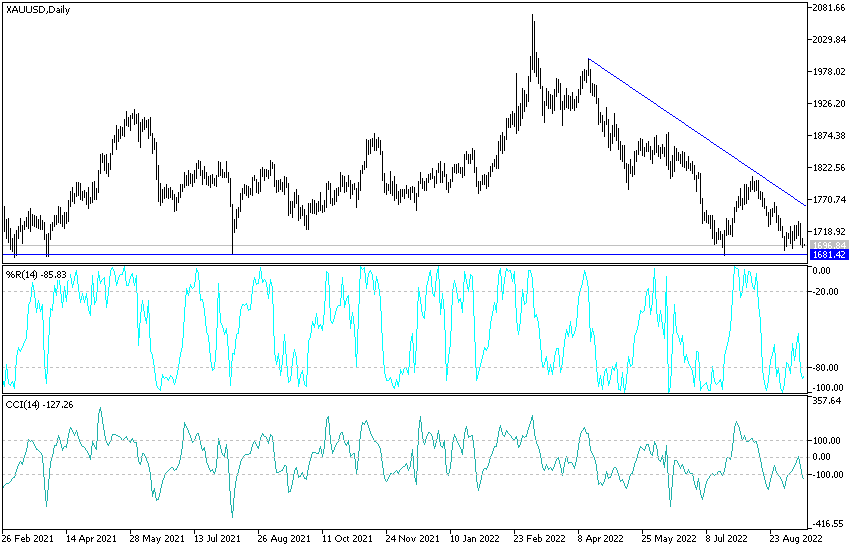

XAU/USD Gold Price Forecast Today:

As mentioned before, the XAU/USD gold price breaching the $1700 support level will give the bears the strong impetus to move further downwards and at the same time towards gold buying levels and stronger ones if the current trend continues at $1688 and $1660, respectively. On the other hand, gold's outlook will not turn upward without breaking the resistance levels of 1735 and 1760 dollars, which in turn supports the move towards the psychological top of 1800 dollars again.

I still prefer buying gold from every bearish level. The price of gold today will be affected by the level of the dollar and the extent to which investors take risks or not, as well as the reaction from the announcement of the results of the US economic data, US retail sales, jobless claims, and the reading of the Philadelphia Industrial Index.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.