Spot natural gas prices (CFDS ON NATURAL GAS) decreased in the recent trading at the intraday levels. At the moment of writing this report, it registered a record loss of 0.88% , settling at the price of $9.113 per million British thermal units. In the previous session, it achieved slight gains, gaining 0.76%. During August, the price increased by 9.26% for the second consecutive month.

US natural gas futures rose on Wednesday and posted their second consecutive monthly rise. It was buoyed by higher-than-normal temperatures, which boosted cooling demand and higher European gas prices in general.

Temperatures are expected to remain above normal in early September but are likely to decline thereafter. This suggests that energy demand may start to trend downward after a warmer-than-expected summer.

Meanwhile, Russian gas flows through Nord Stream 1 have been halted for a three-day maintenance period, a massive blow ahead of a difficult winter in Europe. This happened at a time when European gas prices are approaching recent highs and are likely to remain so in the coming days until flows resume.

Globally the gas was traded at about $77 per million British thermal units in Europe and $59 in Asia.

Investors are now looking forward to the weekly US government inventories report, which is expected to show that utilities added more gas to storage than usual last week. A restart delay at the fire-hit Freeport LNG export terminal in Texas leaves more gas in the US for facilities to refill storage.

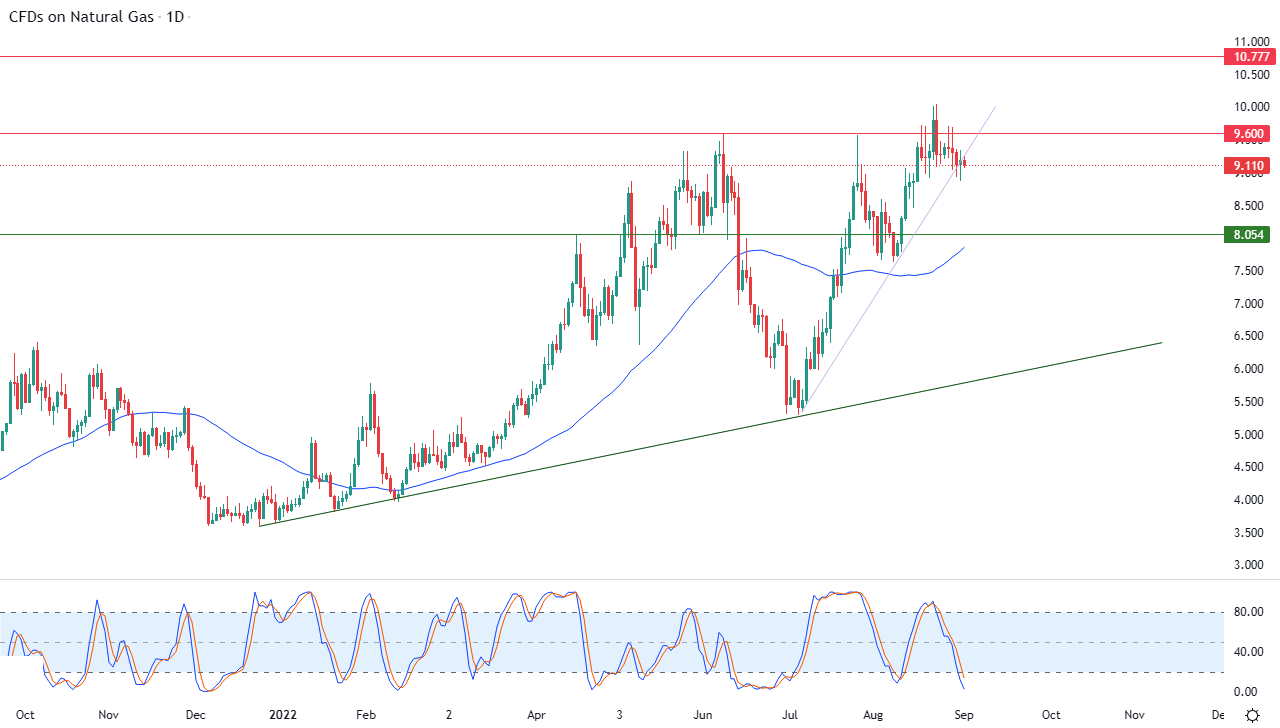

Natural Gas Technical Analysis

- Technically, natural gas is trying to gain positive momentum that may help it recover and attack the pivotal resistance level 9.600.

- Considering the dominance of the main bullish trend in the medium and short term along a slope line, as shown in the attached chart for a (daily) period, with the continued positive pressure.

- It traded above its simple moving average for the previous 50 days, in addition to the relative strength indicators reaching oversold areas, exaggeratedly compared to the price movement, which suggests the beginning of a positive divergence in it.

Therefore, our expectations still suggest a return to the rise of natural gas during its upcoming trading session. It is expected to target again the 9.600 pivotal resistance level, in preparation for attacking it.

Ready to trade our Natural Gas trading prediction? We’ve made a list of the best commodity broker platforms worth trading with.