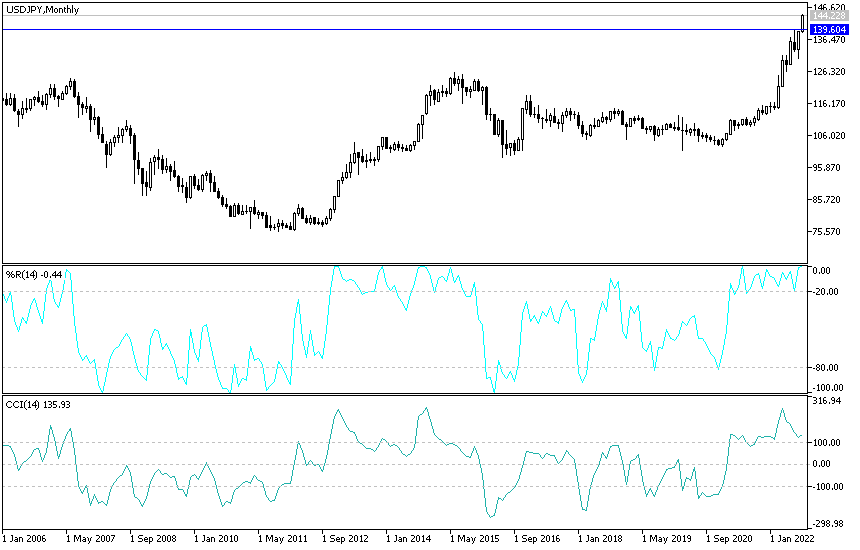

The sharp decline in the price of the Japanese yen continues amid the complete abandonment of officials in Japan from intervening so far to stop the collapse and leads the USD/JPY to a sharp rise. This happened at the beginning of trading today, Wednesday, to the resistance level 143.40, its highest since 1998, and despite the arrival of all technical indicators.

On long-term charts of sharp overbought levels, investors have not had the opportunity to think of profit-taking selling operations so far, as the US dollar is still the strongest in the markets due to strong expectations supported by the results of economic data for the future of raising US interest rates in the coming months.

Japanese yen's remarkable performance

HSBC Holdings Plc is the latest among the biggest financial names to cut their forecasts for the Japanese yen, as the Japanese currency teeters on the verge of its worst annual decline ever. Strategists at the Bank of the United Kingdom see that the Japanese yen may fall beyond 145 against the dollar in the coming months, extending to its lowest level in 24 years, although they remain "contrarian" speculators.

This reflects similar calls recently from Goldman Sachs Group Inc. and Mizuho Securities, as analysts recalculate the impact of the increasingly hawkish Federal Reserve and the Bank of Japan more than willing to resist the trend of global monetary tightening. The Japanese yen fell 0.2% to just below the 141 level on Tuesday. It has fallen more than 18% this year and is close to the record annual decline of 1979 of 19.2%. In this regard, HSBC experts, including Paul McKeill, wrote this week: “We now see USD/JPY staying above 140 in the coming months - and likely to go above 145 - and then declining a little faster in the second half of 2023 to end at the end of the year. The end next year at 130 ″. and “We are delaying our view of the recovery of the undervalued yen until 2023.”

- The Japanese yen slipped past the key psychological level of 140 against the dollar for the first time in almost a quarter century this month as investors refocused on the widening yield gap between the US and Japan.

- This encourages investors to look for more attractive returns in dollar assets from money market instruments to fixed income securities.

- The factors undermining the currency remain intact with higher US yields, higher oil prices adding to pressure on Japan's trade deficit and little prospect of near-term policy adjustment from the strong Bank of Japan.

They wrote in a note this month that Goldman Sachs analysts including Kamakshia Trivedi expect the dollar against the yen to reach 145 within three months, up from a previous forecast of 125. Back in Tokyo, Masafumi Yamamoto, chief forex analyst at Mizuho Securities, raised His forecast for the dollar in yen to 144 by the end of the year from 138, indicating that there were no signs of tightening monetary policy by the Bank of Japan for a while.

"This move is in line with the fundamentals of widening the yield gap," he wrote this week. And “the markets just have to wait for the US interest rate hike cycle to end.” A former official says the Bank of Japan should consider exit steps while sticking to policy

Both HSBC and Goldman Sachs continue to see a peak in the USD/JPY in the coming months for reasons including assessment and the risk that the BoJ is making adjustments to its very loose policy with rising inflation. HSBC also cites the possibility that Japanese investors, tired of high hedging costs, could call back the payment for protection against currency moves, helping to support the yen.

Forecast of the dollar against the Japanese yen today:

The bullish trend of the USD/JPY pair is gaining strength and momentum sharply. The currency pair did not care about the arrival of technical indicators towards overbought levels, as the stronger US dollar is still reacting to the expectations of raising US interest rates. Bullish price gaps for the currency pair are candidates so far, but it is possible to sell without risk, waiting for the activation of short positions to take profits. The nearest resistance levels are currently 143.65 and 145.00, respectively.

According to the performance on the daily chart, and after the last performance, a break of the 139.00 support will be important for a downward correction.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.