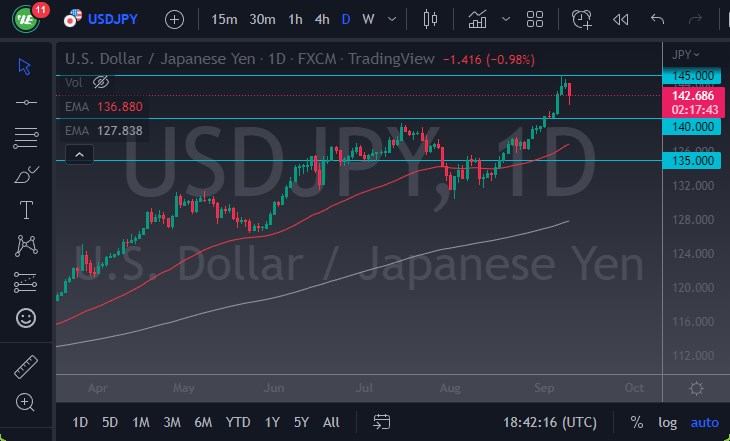

The USD/JPY has pulled back a bit during the trading session on Friday to show signs of hesitation against the Japanese yen. The ¥145 level is a significant resistance barrier, so it does make a certain amount of sense that we have fallen from there, as we had gotten a bit too far ahead.

The ¥140 level underneath is significant support as it had been previous resistance. A certain amount of “market memory” could come back into the picture. If we do pull back, I will be looking for opportunities to pick up a little bit of value, but I would not be looking to short this market under any circumstances. This is because the Bank of Japan will continue to fight rising interest rates, which is the same thing as printing currency. This is because they are buying “unlimited bonds.” In that scenario, it’s very likely that we will continue to see a lot of noisy behavior, and I think given enough time we will find value hunters.

It might be partially since we were so overbought and heading into the weekend that we fell, but it is worth noting that we bounced rather quickly. Even if we do break down from here, I think the ¥140 level should be rather important, right along with the 50-Day EMA which is closer to the ¥137.50 level. The 50-Day EMA is a significant indicator that a lot of people pay close attention to, so it makes quite a bit of sense that we will continue to see that.

Interest Rates Differential Favors Dollar

- On the other hand, if we were to break above the ¥145 level, then I think this pair continues to go much higher, perhaps reaching to the ¥147.50 level.

- Eventually, we could go as high as ¥150, but that’s more a longer-term call than anything else.

- On the downside, if we were to break down below the ¥135 level, then it’s likely that we would drop to the 200-Day EMA, but I don’t think that happens anytime soon.

The US dollar continues to strengthen quite drastically, as interest rates in the American bond market continue to rise. The interest rate differential continues to widen, so therefore it makes a certain amount of sense that we should continue to see this pair climb over the longer term.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.