The bullish stability is still the most prominent performance of the price of the US dollar against the Japanese yen. The performance may remain so until the reaction of investors and markets to the decisions of the US Federal Reserve today about the amount of raising the US interest. This is especially after the US inflation figures, which came stronger than expected. The amount of the increase in the Federal Reserve will determine the amount of gains of the US dollar against other currencies. The USD/JPY currency pair is stable around the 143.90 level at the time of writing the analysis.

In contrast, BoJ Governor Haruhiko Kuroda will run the risk of turning the yen further weakness by sticking to the message that the Bank of Japan should continue monetary easing, hours after the Fed's key rate hike. Kuroda and fellow board members are due to wrap up a two-day meeting on Thursday and are expected to keep both the yield curve control program and asset purchases unchanged, according to all 49 economists polled by Bloomberg.

It is unlikely that any major action from the BoJ will result in a new title for the conflicting central bank amid the global tightening cycle. The Swiss National Bank is expected to cancel its negative rates late Thursday afternoon Tokyo time, leaving the Bank of Japan as the sole member of the central banking world below zero for the first time.

Watch the Yen Closely

The main focus of the meeting will be on whether and how the Bank of Japan will change its wording on future guidance, as it is widely expected to wind down the remainder of its Covid financing programme. Even if the language is adjusted, most BoJ watchers do not expect a shift in the long-term easing bias of keeping rates at or below the current level. Kuroda has countered the speculation about early tightening by the lack of momentum for sustainable inflation. He said after the previous policy meeting in late July that the kind of massive interest rate hikes needed to stem the yen's decline would also end up breaking the economy. With all the recurring and consistent observations even in the face of the yen's fastest ever fall this year, most BoJ watchers don't expect any adjustments before Kuroda steps down in April.

However, investors will be watching closely for any shift in Kuroda's comments regarding the yen. The governor is likely to reiterate that sudden moves increase uncertainty and are negative, without committing to any currency-related action. Last week, Japanese Finance Minister Shunichi Suzuki signaled a growing potential for currency intervention as the Bank of Japan conducted a rare examination of the foreign exchange rate. While confirmation of an interest rate check from the Bank of Japan is unlikely, some analysts are watching whether Kuroda, a former senior currency official, might hint at support for yen buying from the government.

Economists are also watching how a record rise in cases, a continued acceleration in the cost of living and a rapid depreciation of the yen have shaped the Bank of Japan's forecasts for economic growth and inflation. They will be important points for assessing the future course of monetary policy. The yen could still surprise markets with its strength ahead of the BOJ's decision, if the Federal Reserve unexpectedly indicates a shorter tightening cycle in its new forecast.

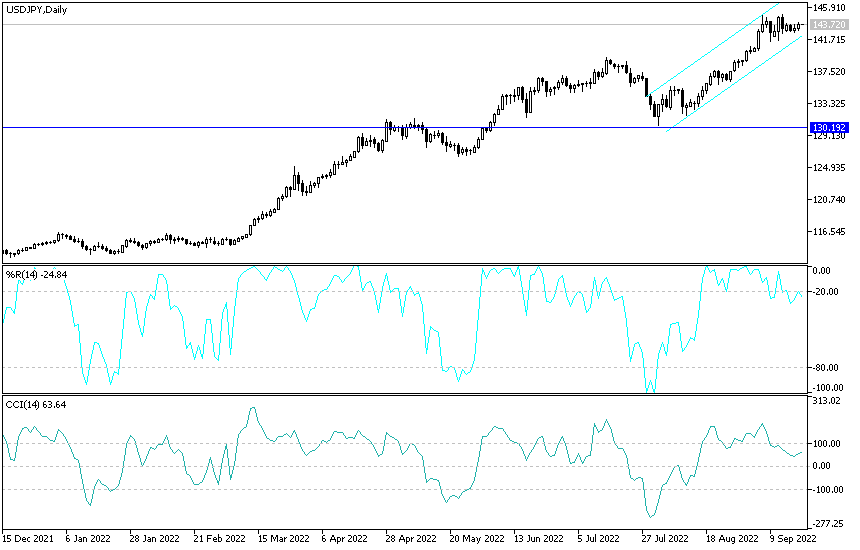

According to the technical analysis of the pair:

- The USD/JPY formed ascending bottoms and found resistance at the key psychological mark of 145.00, which created a bullish triangle formation on the hourly chart.

- The price is currently testing the bottom of the triangle and it could be due to another bounce.

- The 100 SMA is still above the 200 SMA at the moment to confirm the continuation of the uptrend and appears to be establishing as a dynamic support around the bottom of the triangle. Meanwhile, stochastic is trending to show that buyers have the upper hand.

In that case, USDJPY may still be able to bounce back to the top of the triangle from here. The RSI is also heading higher, which means that the pair could follow suit until the overbought conditions are met. However, it appears that the moving averages are preparing for a bearish crossover, which could mean a break below the triangle support soon. If that happens, the USDJPY could fall as high as the chart pattern or close to 500 pips. Stochastic is also nearing the overbought zone to indicate exhaustion among the buyers, so a shift to the downside means the bearish pressure is back.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.