After a period of stability for several trading sessions, I expected that the performance would remain so until the markets and investors react to the US Federal Reserve's announcement of raising US interest rates again. The USD/JPY currency pair jumped to the resistance level 144.70, the highest in 24 years. This happened following the announcement of the decisions and statements of Federal Reserve officials. The dollar-yen pair is stable around the 144.00 level in the beginning of trading today, Thursday, as investors await the next important event, the decisions of the Central Bank of Japan.

The strongest expectations that the Japanese central bank will continue to maintain its monetary policy, but the anticipation of the bank's hints about the level of the collapsed Japanese yen, especially against the US currency.

More Increases than Expected

Federal Reserve Chairman Jerome Powell pledged that officials would crush inflation after they raised US interest rates by 75 basis points for the third time in a row, and pointed to more robust increases than investors had expected. "We have to put inflation behind us," Powell said at a news conference in Washington on Wednesday after officials raised the target for the federal funds rate to a range of 3 percent to 3.25 percent. I wish there was a painless way to do that.” “High interest rates, slow growth and a weak job market are all painful to the audience we serve. But they are not as painful as failing to restore price stability and having to go back and do it all over again.”

The US stock index S&P 500 finished near session lows - pushing its decline from a record high in January to more than 20 percent. The gauge struggled to find direction in the wake of the Fed's announcement, rising 1.3 percent at one point. Two-year Treasury yields crossed 4 percent, breaking that level for the first time since 2007.

Officials expect rates to reach 4.4 percent by the end of this year and 4.6 percent in 2023, a tighter turnaround in their so-called point plot than had been expected. That means a fourth straight 75 basis point hike may be on the table for the next meeting in November, about a week before the US midterm elections. The Fed Chairman agreed that the quarterly average forecast provided by policy makers implied another 125 basis points of tightening this year. But he said that no decision had been made on the size of the price increase at the next meeting and stressed that a fairly large group of officials favored raising prices by only a percentage point by the end of the year.

USD/JPY Forecast

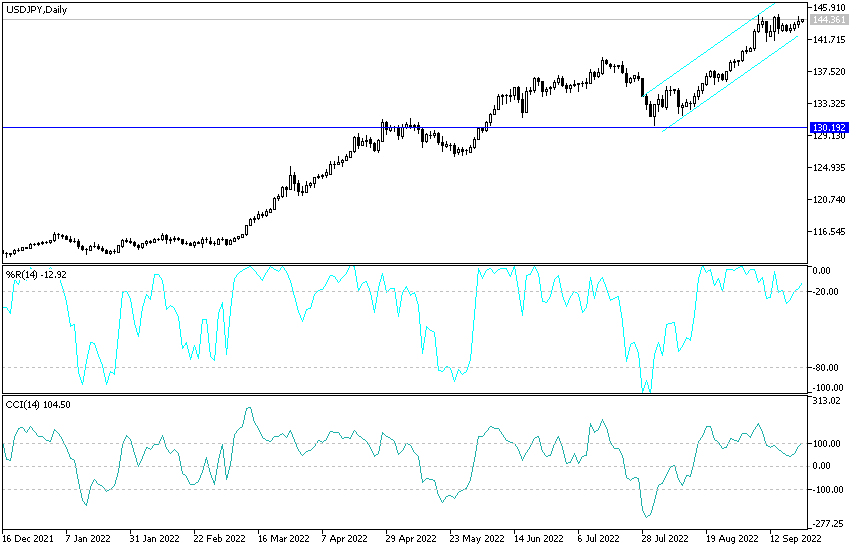

- The general trend of the USD/JPY currency pair is still bullish.

- The recent bounce increased the bulls' dominance and at the same time pushed the technical indicators towards overbought levels.

- Forex traders may think of hunting short positions in anticipation of profit taking at any time.

- The resistance levels 144.75 and 145.50 may be the most appropriate to do so.

As I mentioned before and according to the performance on the daily chart, a first break of the trend will not occur without crossing the barrier of the 141.90 and 140.00 support levels, respectively.

Otherwise, the trend for the USD/JPY pair will remain to the upside. The currency pair will be affected today by the risk appetite of investors as well as the reaction from the announcement of the US weekly jobless claims number.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.