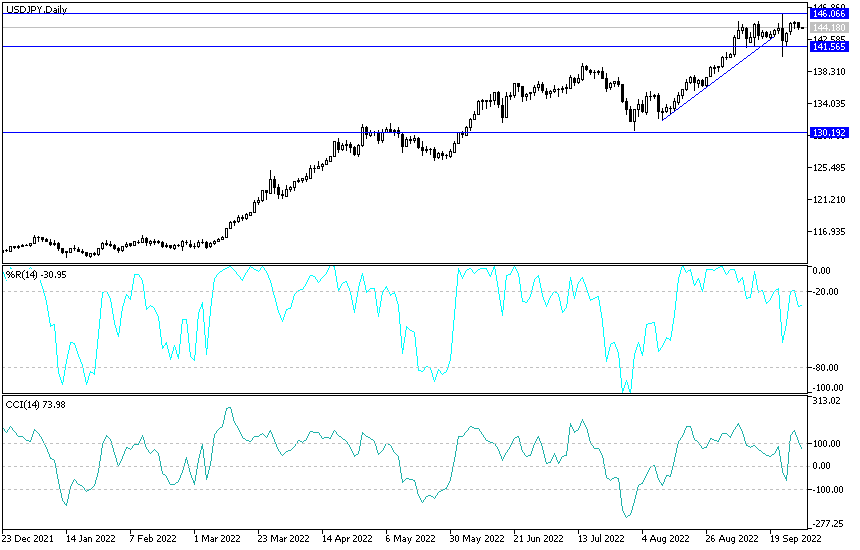

After three bullish trading sessions, the price of the USD/JPY currency pair moved with gains to the 144.90 resistance level, near the highest in 24 years. It is in the vicinity of levels that recently triggered a Japanese intervention to prevent further collapse of the Japanese yen.

- Profit-taking sales returned, as the currency pair settled around the 144.00 level at the time of writing the analysis.

- The US currency is still the strongest in front of everyone, as expectations of a US interest rate hike are still increasing.

- The results of recent economic data support the course of Jerome Powell's policy to contain US inflation, which recorded its highest level in 40 years.

USD/JPY Economic Data

US pending home sales fell in August for the seventh time this year, perpetuating a housing market slump as rising borrowing costs sidelined potential buyers. The National Association of Realtors' index of pre-owned home purchases fell 2% last month to 88.4 - the lowest level since 2011, excluding the direct effects of the pandemic - according to the data released. The median estimate in a Bloomberg survey of economists called for a 1.5% drop.

The US housing market was disintegrating as the Federal Reserve continued its assertive path of raising US interest rates to combat inflation, pushing mortgage rates to their highest levels since 2008. This affected demand as well as building sentiment, indicating new construction activity. Silent to come. A report earlier on Wednesday showed that a gauge of mortgage applications fell last week to the lowest level since 1999. Separate data on Tuesday showed that a national gauge of prices in 20 large cities fell in July, the first decline since March 2012.

Lawrence Yun, chief economist at NAR, said in a statement: “The trend of mortgage rates — up or down — is the main driver of home buying, and high interest rates have been lowering for decades.” And “only when inflation subsides will we see mortgage rates begin.” in stability.” Contract signings fell in three of the four regions while the West posted a slight increase, similar to the July data. Compared to the previous year, contract signings were down 22.5% on an unadjusted basis. Pending home sales are often seen as a leading indicator of current home purchases because properties are subject to a contract for a month or two before they are sold. Sales of previously owned homes, calculated at the close of the contract, fell for the seventh straight month in August.

Forecast of the dollar against the Japanese yen today:

The recent profit taking operations did not break the USD/JPY out of the bullish trend. The bulls are in control, supported by the expectations of a US interest rate hike, and therefore any decline would be an opportunity to consider buying the currency pair again. The closest support levels for the pair are currently 143.10 and 141.80, respectively. It must be taken into consideration that the bulls' movement above the resistance 145.50 will increase the markets and investors talk about a new intervention from Japan to prevent further collapse of the Japanese yen.

The currency pair will be affected today by the announcement of the growth rate of the US economy as well as the number of US weekly jobless claims, as well as the extent to which investors take risks or not.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.