Today, the markets will be watched with the latest important and influential US economic data for this week. There is fear among investors because of the reaction, as did the announcement of US inflation numbers that are stronger than expected, which increased the upward momentum of the US dollar against the rest of the other major currencies. The share of the dollar currency pair was the US dollar against the Japanese yen (USD/JPY) rebounded towards the resistance level 144.95, its highest in 24 years, after which the currency pair was exposed to profit-taking operations that pushed it towards the support level 142.50 and settled around the level of 143.13 at the time of writing the analysis.

The latest data has dashed hopes that US inflation may be easing and is widely expected to cause concerns at the Federal Reserve barely a week after the September rate decision, leading many analysts and economists to anticipate some of the strongest actions yet from Federal Reserve Bank.

US Inflation Rates Decreased

The overall rate of inflation in the United States decreased slightly from 8.5% to 8.3% in August, but it did not fall as much as the market had expected due to the large increase in food prices on a monthly basis, while the rate of core inflation rose. In both the monthly and annual periods. Core inflation ignores volatile energy and food costs, so the August surge is likely to be a particular concern for Fed policy makers who have already been inclined to do too much and too soon with US interest rates rather than risk doing too little and too late.

All of this comes at a time when Fed officials have been expressing increasing concerns about the rising expectations of businesses and households regarding inflation.

The August inflation spike also came at a time when Fed officials, including Chairman Jerome Powell, were increasingly looking to the 1980s in their public remarks, and the time of former Fed Chairman Paul Volcker, for insight into how to deal with inflation. Present. Governor Volcker was notorious for using brutally high borrowing costs to drive double-digit inflation rates out of the US economy between 1979 and 1987, which was a volatile period for global financial markets as well as the US dollar.

Forecast of the dollar against the Japanese yen today:

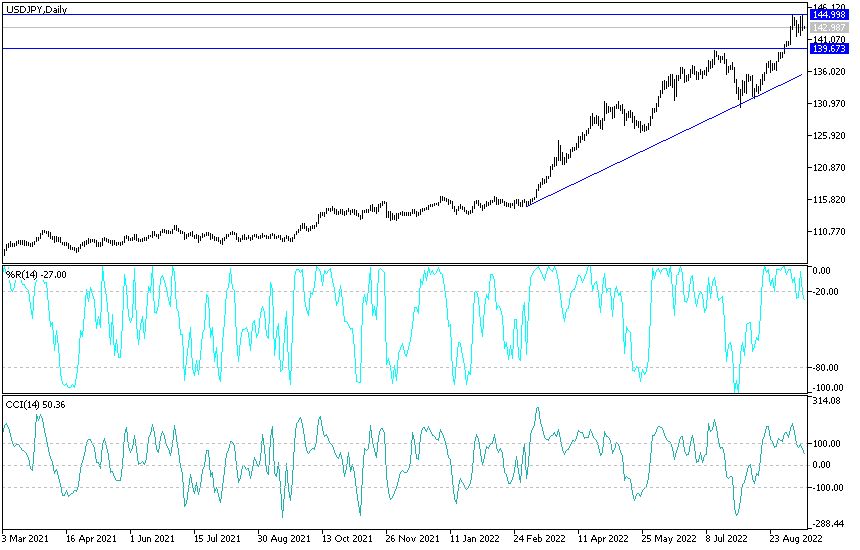

- The recent sell-off did not break the USD/JPY out of its ascending channel range, which was normal after the highest gains in 24 years.

- An actual break and permanent change of direction will not occur without breaching the 140.00 support, which still supports the bulls' control of the trend.

- I expect the current trend to continue until the US Federal Reserve announces next week or until Japan intervenes to prevent further collapse of the Japanese currency.

Currently, the nearest resistance levels are 144.00, 144.85 and 145.60, respectively. The currency pair will be affected today by the risk appetite of investors, as well as the reaction from the release of US retail sales figures, weekly jobless claims, and Philadelphia manufacturing index.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.