Today's recommendation on the USD/TRY

- Risk 0.50%.

- The buying recommendation was activated yesterday, half of the contracts were closed, and the stop loss point was moved as the price moved towards the target.

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best buying entry points

- Entering a long position with a pending order from the 18.10 level.

- The best points for setting stop-loss are closing at levels over 17.94.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the 18.31 support level.

USD/TRY Analysis

Despite the strong movement during the early trading, the price of the USD/TRY returned to settle at the same levels that it has been trading at for nearly a month. Investors followed news reports this morning that showed the Turkish government raising the price of energy in the country (gas and electricity) in varying proportions, as an increase in electricity prices was approved by 20 percent for households and 30 percent for electricity used for the service sector.

Additionally, the Turkish government approved an increase of 50 percent for the price of electricity for the industrial sector. This may be reflected in the inflation rate in the country, which is at its highest level since 1998, when it recorded 80 percent during the month of July. The lira had witnessed a strong movement before stabilizing near its lowest levels during the current year, since nearly a month, as the central bank’s control appears clearly in the price of the lira, which hardly moves under the influence of any positive or negative news.

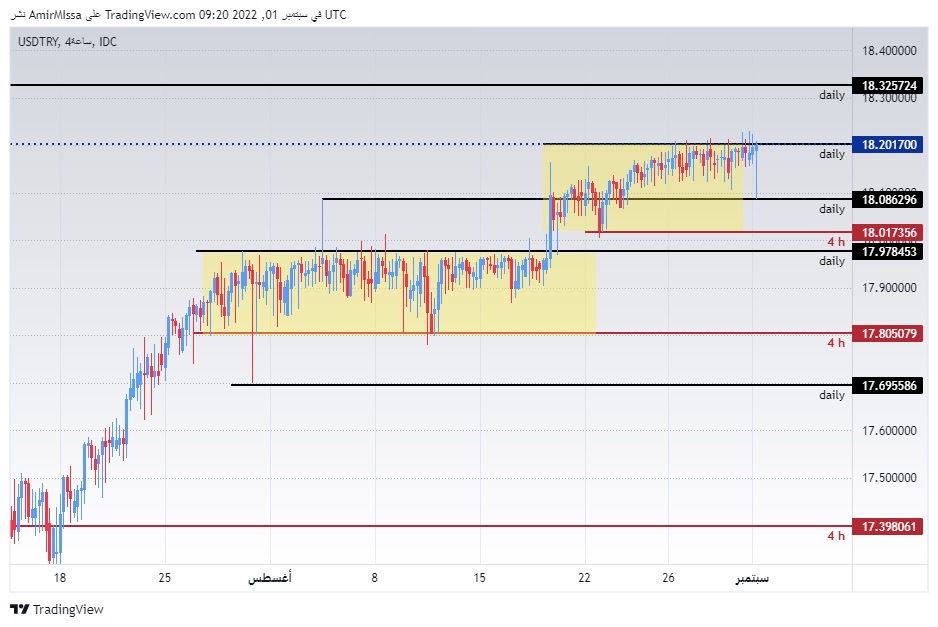

On the technical front, the USD/TRY settled within the narrow trading range shown on the chart, near its highest levels during 2022. The pair traded the highest levels of support, which are concentrated at 18.08 and 17.98 levels, respectively. While it is trading below the resistance levels at 18.20 and 18.33, which are the highest levels of the pair recorded at the end of last year, respectively.

The currency pair is also trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. As each decline of the pair represents a good buying opportunity, please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our advanced signals? We’ve made a list of the best brokers to trade Forex worth using.

Ready to trade our advanced signals? We’ve made a list of the best brokers to trade Forex worth using.