Today's recommendation on the USD/TRY

- Risk 0.50%.

- None of the buy or sell transactions of yesterday were activated

Best selling entry points

- Entering a short position with a pending order from the 18.33 levels.

- Set a stop-loss point to close the lowest support levels, at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the 17.70 strong resistance level.

Best buying entry points

- Entering a buy position with a pending order from the 18.16 level.

- The best points for setting stop-loss are closing the highest 17.94 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the 18.31 support level

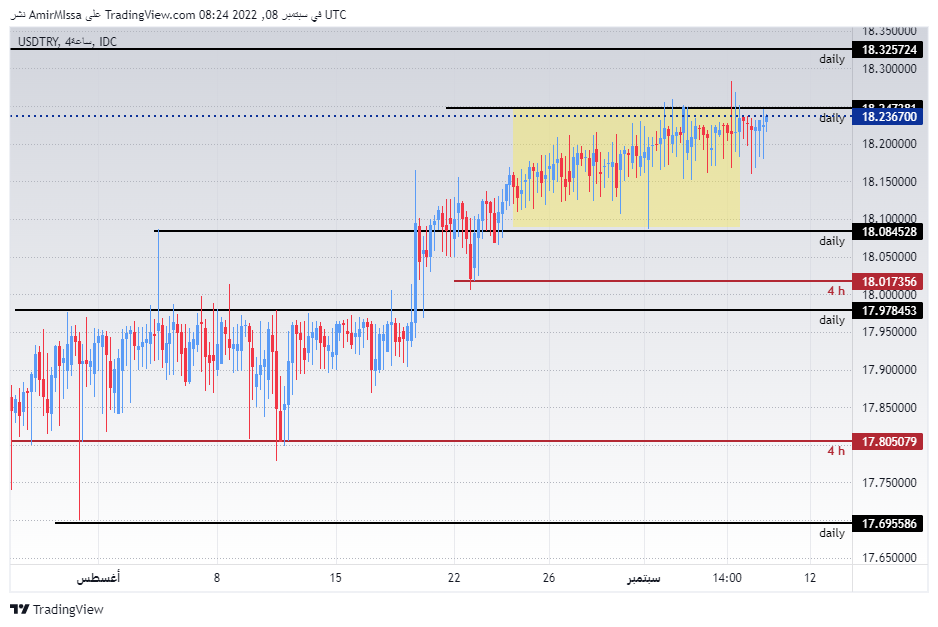

USD/TRY Technical Analysis

The lira was affected by the new monetary policy pursued by the Turkish Central Bank, which focuses on increasing production away from raising interest rates, which aims to attract hot money to the economy. It is noteworthy that the economic data shows the extent to which the situation has faltered inside the country, with inflation reaching record levels not recorded in nearly 24 years. The Turkish Central Bank lowered the interest rate last month by about 100 basis points, which contributed to putting pressure on the lira’s price relatively in exchange for the hawkish statements of the members of the US Federal Reserve, which gave the US currency strength against the major currencies and the currencies of emerging economies.

On the technical front, the USD/TRY recorded stability near the new top that the pair recorded during yesterday's trading at the 18.27 level, before settling within a narrow range, which is shown on the chart. The pair traded the highest levels of support, which are concentrated at levels of 18.10 and 17.98, respectively. While trading below the resistance levels at 18.28 and 18.33, respectively.

The pair is also trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. Each decline of the pair represents a good opportunity to buy, please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.