Today's recommendation on the USD/TRY

- Risk 0.50%.

- None of the buy or sell transactions took place in the past week

Best buying entry points

- Entering a buy position with a pending order from the 18.16 level.

- Set a stop-loss point to close below the 17.95 support level.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.31 strong resistance level.

Best selling entry points

- Entering a sell position with a pending order from the 18.32 level.

- The best points for setting stop-loss are closing the highest 18.55 level.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 17.85 support level.

USD/TRY Technical Analysis

The US dollar stabilized against the Turkish lira with minor changes, as the pair maintained its sluggish rise. Investors followed early data issued by the Turkish Statistical Office, which showed a decline in retail sales in the country. The indicator stood at 2 percent, compared to 5.5 percent on an annual basis. On a monthly basis, retail sales rose even if they remained in the negative region, recording -.03 percent During August, compared to -0.7 percent in July.

In the meantime, reports from the Turkish Central Bank showed an increase in foreign money flows. The Central Bank’s report suggested the source of this increase was the citizens’ savings of hard currency by about 5.5 billion dollars during the month of July. This implies that the total flows during 2022 would be about 24.4 billion dollars.

This contributed to the idea that the bank’s reserves will be further strengthened, despite the country's trade deficit. This increase in foreign exchange flows allows the Central Bank to help balance the price of the lira, which is under almost constant pressure due to stimulus monetary policy, through direct or indirect intervention in the foreign exchange market.

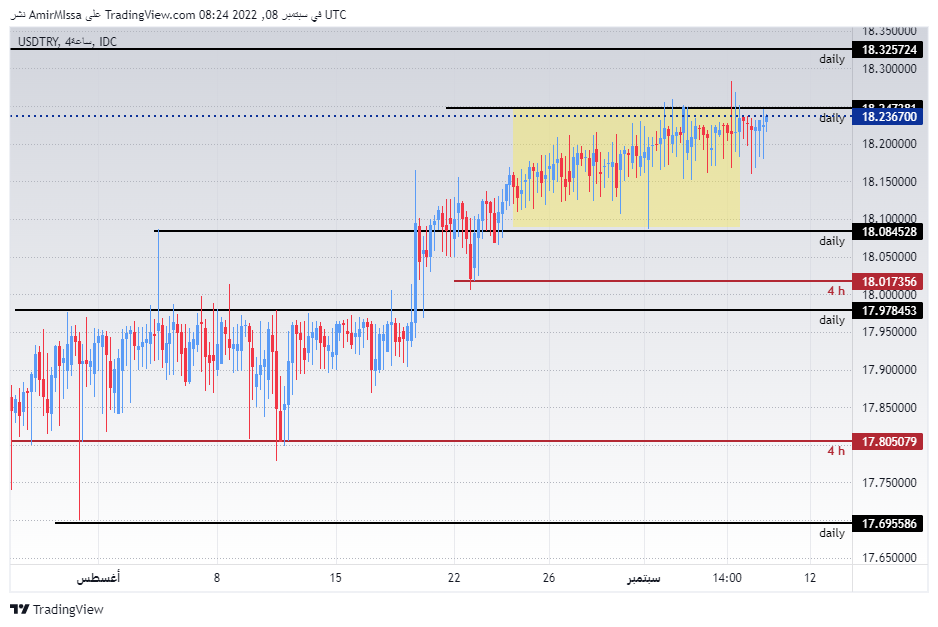

On the technical front, the price of the lira against the dollar recorded slight declines during the early trading, while the pair continued trading in a narrow range shown on the chart. The pair is also based on an ascending trend line on the four-hour time frame.

The USD/TRY is trading near the highest 18.27 level. The pair is still trading above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-time frame, where the pair maintained the bullish trend. The pair is also trading at the highest support levels, which are concentrated at 18.18 and 18.07 levels, respectively. On the other hand, the lira is trading below the 18.27 and 18.32 resistance levels. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our advanced signals? We’ve made a list of the best brokers to trade Forex worth using.

Ready to trade our advanced signals? We’ve made a list of the best brokers to trade Forex worth using.