Today's recommendation on the TRY/USD

- Risk 0.50%.

- The buy trade of Thursday was activated, and a profit was exited with the price moving towards the target and moving the stop loss point towards the entry point

Best buying entry points

- Entering a buy position with a pending order from levels of 18.16

- Set a stop-loss point to close below the 18.05 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong 18.31. resistance levels.

Best-selling entry points

- Entering a sell position with a pending order from the 18.32 level.

- The best points for setting stop-loss are closing the highest 18.55 level.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 17.85 support level.

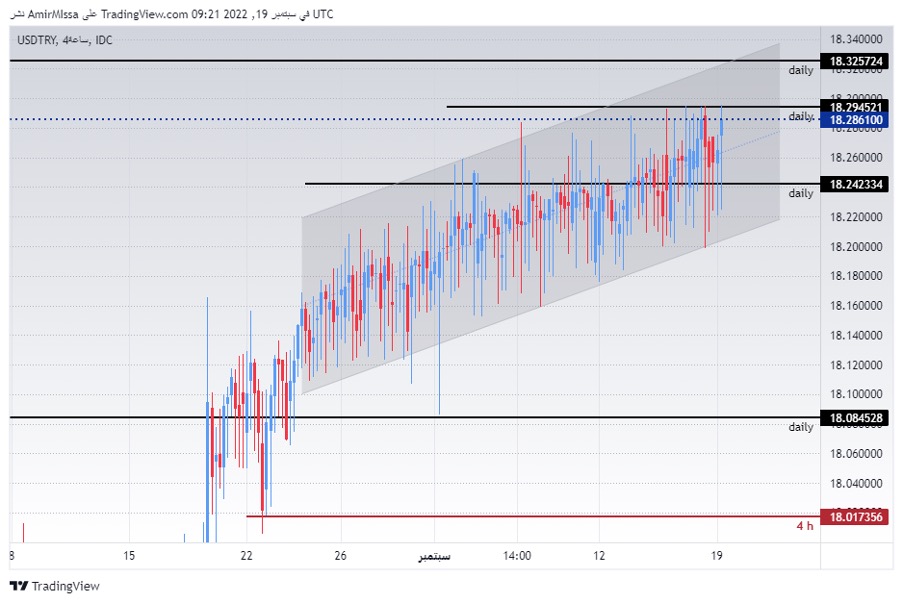

The USD/TRY continues to move within a weak upward trend, recording slight increases. Investors followed early data from the Ministry of Treasury and Finance that showed an increase in the central Turkish government surplus by about $200 million, or the equivalent of 3.6 billion lira, during the month of August.

The data showed an increase in expenditures by more than 180 percent compared to August of last year, when it recorded about 302 billion Turkish liras. As usual, the data did not show any negative or positive impact on the lira’s path. The currency continues to move slowly in a general downward trend at a slow pace that reflects the extent of the Turkish Central Bank’s intervention and control over the market. Previous reports showed that the Turkish Central Bank has pumped more than 70 billion dollars during the current year to maintain on the value of the lira collapse. At the same time, the central bank continues the policy of fiscal stimulus after cutting the interest rate by a full percentage point during the last month.

USD/TRY Technical Analysis

On the technical front, the price of the lira continued to decline slightly against the dollar during the beginning of the week's trading. The pair continued trading in a narrow range of movement shown on the chart. It is still trading within an ascending channel on the four-hour time frame. 18.28. And it is still trading above the 50, 100 and 200 moving averages on the daily time frame, as well as on the four-time frame, where the pair maintained the bullish trend.

The USD/TRY is also trading the highest levels of support, which are concentrated at levels of 18.20 and 18.16, respectively. On the other hand, the lira is trading below the resistance levels at 18.28 and 18.32. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.