The EUR/USD exchange rate has entered the new week's trading in full swing in a bearish market. The pair may be at risk of pulling back near its lows in late September in the coming days unless data from the US economic calendar or some other factor is able to stop continuous rise in US exchange rates.

- The EUR/USD currency pair continued to decline and recorded the 0.9681 support level, the lowest in two weeks.

- The euro was lower at the start of the week after risky assets were given a wide berth as investors digested the weekend developments in Ukraine and the reopening of Chinese financial markets after a week-long holiday.

Commenting on this, Lee Hardman, FX Analyst at MUFG said, “The US dollar is drawing support from more risk-off trading conditions at the start of this week, which partly reflects the hawkish re-pricing of US rate hike expectations, as well as some concern about the conflict in Ukraine.” "Ukraine's weekend attack on the Kerch bridge linking Crimea with Russia threatens Russia's ability to resupply forces in the south and perhaps most importantly cross Russia's red lines," the analyst added.

The euro did not benefit when Dutch Central Bank Governor and ECB Governing Council member Claas Knott said that "the ECB will continue to raise interest rates until there is once again a credible prospect of returning to the stability target of 2% inflation over the medium term."

Quiet week for Europe

Monday's loss left the euro on its way to a fourth decline at the opening of what will be a quiet week for European economic data but a busy period in the US calendar, which presents US inflation figures for September as well as retail sales data and public statements from a group of Federal Reserve officials. “The data calendar for this week in the eurozone is relatively light with the focus likely on the speeches of ECB Chief Economist Philip Lane today and tomorrow, and ECB President Christine Lagarde on Wednesday,” says Valentin Marinov, FX analyst at Credit Agricole.

Overall, the euro and other currencies have come under almost relentless pressure from the dollar in recent months, but were further burdened in late September due to the tighter interest rate stance adopted by the Federal Reserve last month.

Meanwhile, a lot of US data continued to shed light on the economy in a resilient light with the Fed's more hawkish stance. According to analysts, the broader macro background suggests that hawkish comments from ECB officials this week will have only a passing effect on the EUR.

While the euro has already fallen a long way against the dollar, and financial markets are almost fully priced at the Fed's September rate forecast, the US dollar has shown few signs of easing in its advance, so the risk is further losses for the euro. The euro price may benefit this week if Thursday's data reveals a surprising moderation in core inflation in the US or if Friday's retail sales numbers surprise sharply to the downside of expectations, although recent history suggests that any easing of this The type is likely to be transient.

Thursday's US inflation numbers are the highlight of the US calendar this week, but Wednesday's meeting minutes from the Federal Reserve's September meeting and Friday's release of US retail sales numbers for September will be closely scrutinized by the market as well.

Forecast of the euro against the dollar today:

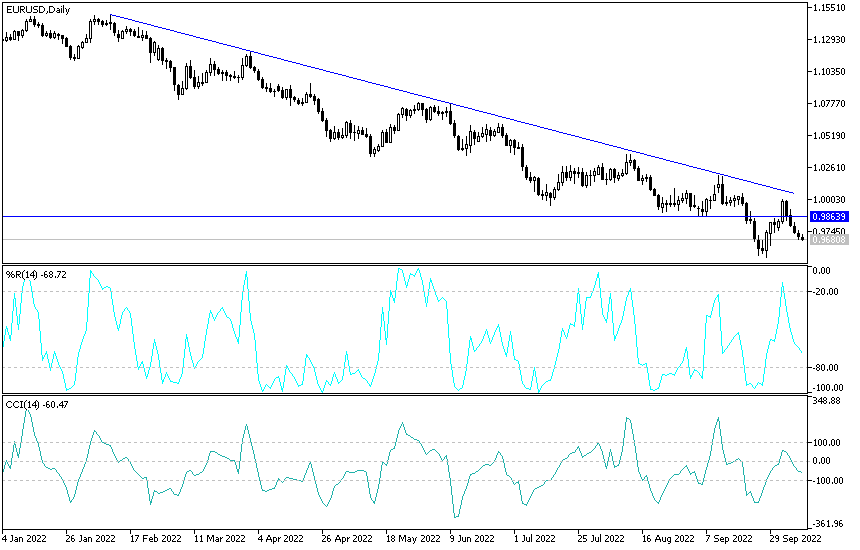

- According to the performance on the daily chart below, the general trend of the EUR/USD is still bearish as long as the currency pair is stable below the parity price.

- It must be taking into account that the currency pair’s move towards the support levels 0.9625 and 0.9500, respectively, will move the technical indicators towards strong saturation levels.

- On the upside and on the same time period a break above the parity rate of 1.0000 will be important for the bulls to start doing something to change the direction of the currency pair.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.