Since the minutes of the last meeting of the US Federal Reserve did not bring anything new to the financial markets, as the bank is still determined to continue raising US interest rates until the record containment in the country. Today, the EUR/USD currency pair will be interested in announcing US inflation figures, which will have a strong and direct reaction to the expectations of raising US interest rates. The EUR/USD is stabilizing around the 0.9700 level at the time of writing the analysis and is still moving in a narrow range until the markets react to the important US data this week.

European Central Bank President Christine Lagarde said that the euro zone economy is still growing even as concerns persist about the outlook in the face of rising energy costs. “Europe is not in a recession,” Lagarde said Wednesday at an event in Washington, adding that “we have never had such a positive employment situation.”

The assessment of the European Central Bank president contrasts with the assessment of economists. According to a Bloomberg survey of forecasters, the eurozone will contract in both the current quarter and the first three months of 2023. Lagarde also said that wages - which central bankers are watching closely - have so far avoided regulating the so-called second-round effects that would threaten to entrench inflation elevated for a longer period.

For its part, the German government said this week that the energy crisis will likely lead to a contraction next year for the third time since the financial crisis, with production shrinking by 0.4%. For his part, Dutch board member Klaas Knott said earlier on Bloomberg TV that the European Central Bank needs at least two "significant" increases in interest rates to reach a level that does not constrain or stimulate the economy. Some officials have indicated a preference for repeating last month's 75 basis point increase when officials make a policy decision on October 27.

Lagarde added that rate increases are the ECB's most effective tool at the moment, although she also emphasized that discussions about reducing the central bank's balance sheet have begun and will continue.

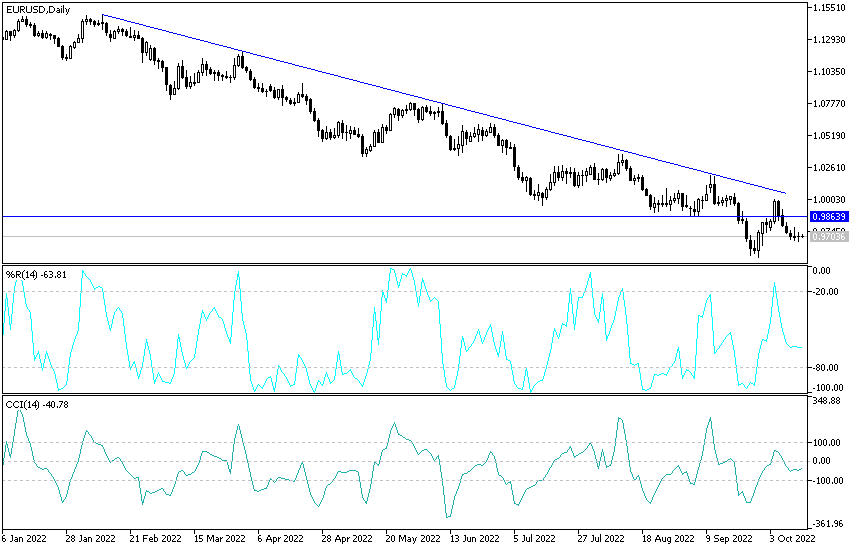

Forecast of the euro against the dollar today:

- Since there is no change in performance, no change in expectations, the general trend of the EUR/USD is still bearish and will remain so until the markets react to the US inflation and retail sales figures.

- Currently, the bears' closest targets to the trend are the support levels 0.9665 and 0.9550, respectively, which are sufficient to push the technical indicators towards oversold levels.

- On the upside and according to the performance on the daily chart below, the EUR/USD must move above the parity price to be a first chance to change the current downtrend.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.