The Euro remained one of the top performing major currencies last week even after the European Central Bank's October decision prompted the market to mistakenly adjust its expectations for lower interest rates. The EUR/USD currency pair gained gains, reaching the resistance level of 1.0093, before settling around the 0.9960 level at the beginning of this week's trading. The Euro tried to hold back from the widespread losses incurred in the wake of last Thursday's European Central Bank policy decision, which saw all interest rates hiked for the third time in a row but left the market with less certainty than what to expect from the bank in the coming months.

The European Central Bank said that “significant progress” has been made in withdrawing monetary support to Europe’s economies in recent years, but that further rate increases are likely to be needed, which markets have taken to mean the central bank’s interest rate cycle. This interpretation was demonstrated by the decline in expectations implied in the indexed swap market as interest rates shifted to indicate that some investors now expect that the previously negative ECB deposit rate will exceed 2.55% next year, down from 2.8% before the day's decision last Thursday.

However, some board members have since argued that the market was wrong in its interpretation of the latest policy statement. Following the decision, Slovak Central Bank Governor Peter Casimir said, “There is a risk that inflation in the euro area will remain higher for a longer period, and we will remain above the target despite the expected decrease in inflation over the next two years. This is unacceptable, and we need to take action." He later added at the conclusion of an editorial: “We will cross the neutral price (no matter where anyone currently sees it) like a runaway train. We need to introduce monetary policy into the restrictive environment, at least for a certain period.”

The official's comments suggest that the ECB's previously highlighted comments were in fact a reference to a "neutral interest rate" as well as an indication that the ECB intends to raise interest rates above there and to a restricted level as part of its efforts to bring back inflation to target 2%. This would be just one explanation, however, there are now 20 national central banks represented on the ECB Governing Council so not much can be said for sure until the next meeting in December.

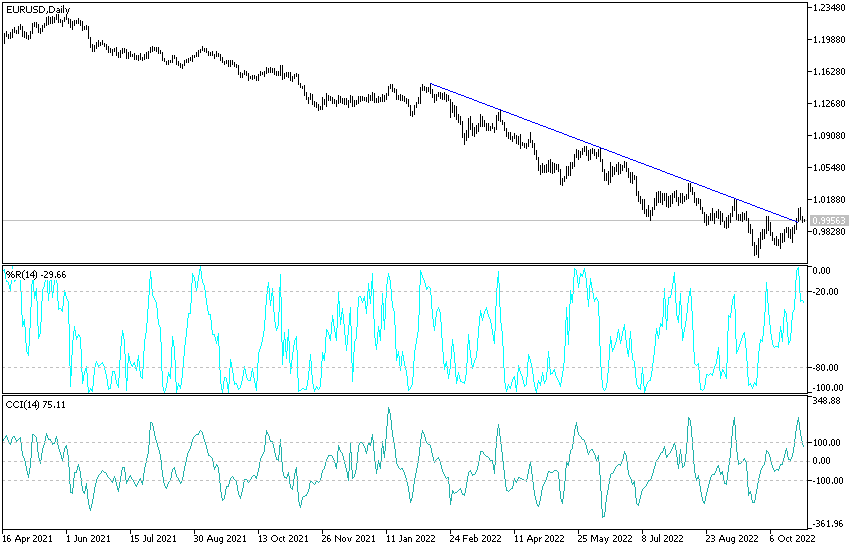

EUR/USD Technical Analysis:

- The EUR/USD currency pair rose again above the parity rate but reached a ceiling around the key psychological level of 1.0100.

- A pullback to nearby support levels may be needed to gather more bullish energy.

- The Fibonacci retracement tool shows where more buyers are waiting.

- As 38.2% is close at the .9950 minor psychological mark, then the 50% level lines up with the area of interest at the .9900 handle.

The bigger retracement might reach 61.8% Fibonacci near the minor psychological level of 0.9850, which is in line with the rising trend line seen on the short-term time frames. If any of the Fibonacci hold as support, EUR/USD could find its way back to the swing high and beyond. Currently the 100 SMA is above the 200 SMA to indicate that the trend has a chance to go up and that the support is more likely to continue than to be broken. The gap between the indicators is widening to reflect the strength of the upward pressure.

Stochastic is already rising to show that buyers are regaining the upper hand while tired sellers are taking a breather. It also appears that the RSI is heading higher, so EUR/USD may follow suit while bullish momentum builds.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.