The Bank of England (BoE) interest rate announcement deepened the economic downturn.

Overall and while a lot of ink will inevitably be spilled on Westminster this week, there are other equally important things for the Pound including the market's response to the expected end of BoE's intervention in the bond market. The Bank of England has bought nearly £20 billion in government bonds since September 28 and an incident that Governor Andrew Bailey described on Saturday as a "liquidity event" prompted the Bank of England to intervene the Wednesday after the September 23 financial event. Sterling appears to be benefiting from this intervention, and therefore could be vulnerable to any new or other liquidity pressures should they arise, although Tuesday's release of September inflation figures and the trajectory of the US dollar will also be significant.

GBP/USD Forecast

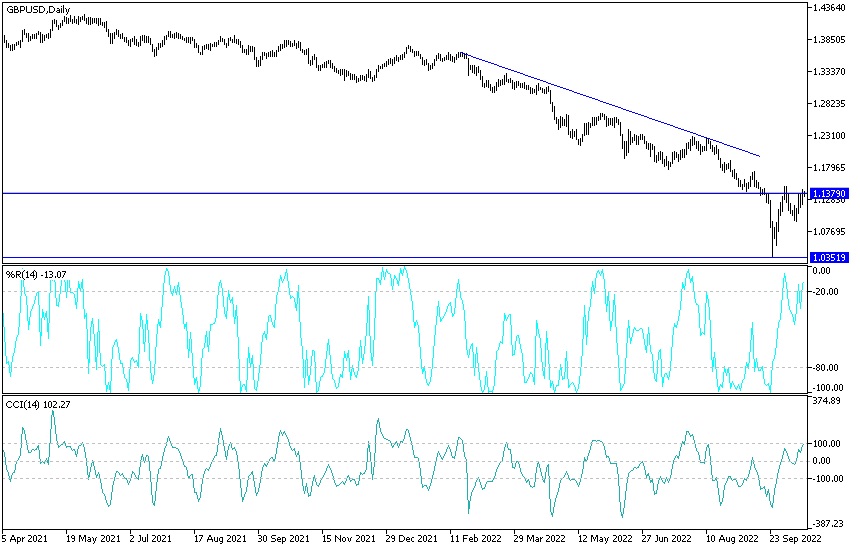

- According to the performance on the daily chart below, in the event that the current bullish rebound of the GBP/USD currency pair is completed, the formation of the head and shoulders may appear clear.

- Unless the sterling gets strong momentum, the selling of the sterling dollar may return, which I strongly expect.

- The sterling is vulnerable to a rapid collapse as the political and economic anxiety in Britain continues and may take a lot of time. The closest targets are 1.1475, 1.1520 and 1.1600, respectively.

On the downside, the break of the 1.1170 support will end the current bulls' expectations. I still prefer selling sterling dollars from every bearish level.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.