- Strong volatility and the absence of a clear direction continue to affect the performance of the GBP/USD currency pair, in light of concerns about the future of political and economic life in Britain.

- During the last week's trading, the sterling dollar pair lost a lot of its gains, as it collapsed from the 1.1440 resistance level towards the 1.1060 support level on Friday, before closing the week's trading stable around the 1.1295 level so far.

- The sterling's gains will remain vulnerable to a rapid collapse until investor confidence in the pound returns.

All in all, the British pound was diving deep in the red against most of the other major currencies before the weekend due to the fact that bad economic numbers and the process of selecting the British Prime Minister dominated the agenda, sparking a lot of comments from analysts and economists. Sterling exchange rates were a sea of red throughout most of Friday's session which started with the release of the horrific UK retail sales figures from the Office for National Statistics covering the month of September.

The data was said of a well-established Main Street downtrend deepening to pull total sales back below the pre-coronavirus level in September while taking a cut in online sales. This has proven more resilient thus far in the post-pandemic period. These numbers were accompanied by other data, such the 1% increase in government borrowing, which was more than estimated . The public sector balance sheet is still expected to deteriorate further in the coming months, although the broad extent to which the debt burden grows will depend heavily on the policies of the next British prime minister. Among these candidates are former Prime Minister Boris Johnson and the market favorite in the form of Johnson's senior adviser, Rishi Sunak.

"By the end of next week, the UK will have a fifth Prime Minister in six years. The top contenders are here. The process is explained here. Meanwhile, sources indicate that the British Treasury is likely to delay the financial plan on October 31 now. This means that the Bank of England’s decision will not be included in its decision on the 3rd of November,” stated CIBC Capital Markets' in an analysis.

“The libertarian brand of Truss is long overdue. It has been the fate of 'low taxes + deregulation, Scandinavian-type services with American-style taxes' from the start. The specter of former Prime Minister Johnson looms large. Although he left office only 45 days ago and the ex-prime minister could hold a vote, if he did, we can expect sterling assets to be at risk,” they added.

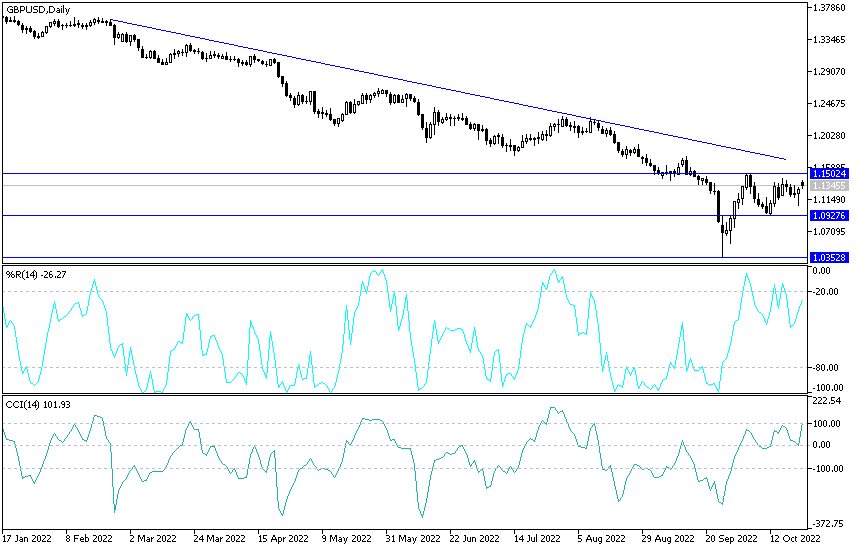

GBP/USD Technical Outlook:

In the near term and according to the performance on the hourly chart, it appears that the GBP/USD is trading within an ascending channel formation that lacks the momentum to complete the strong rebound. This indicates a strong short-term bullish momentum in market sentiment. Therefore, the bulls will look to extend current gains towards 1.1356 or higher to 1.1409 resistance. On the other hand, the bears will target a potential pullback at around 1.1241 or lower at 1.1182 support.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within a slightly ascending consolidating triangle formation. This indicates a slight long-term bullish momentum in the market sentiment. Therefore, the bulls will look to extend the current gains to 1.1483 or higher to the 1.1704 resistance. On the other hand, the bears will target potential pullbacks around the 1.1078 support or lower at the 1.0856 support.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.