The GBP/USD exchange rate remained high near its highest levels in the week after the US Federal Reserve's preferred inflation measure dampened expectations and did nothing to persuade the market to bid again on the dollar ahead of next Wednesday's interest rate decision. The GBP/USD pair's recent gains reached the 1.1645 resistance level, the highest in more than a month and a half and settled around the 1.1585 level at the beginning of this week's trading.

At the end of last week's trading Sterling held comfortably above 1.15 against the dollar especially after the core personal consumption expenditures (PCE) measure of US inflation surprised to the downside of economists' expectations. It was also lagging behind the official measure of core inflation reported earlier in October. PCE price indices are the Fed's preferred measure of inflation, so FOMC members this week may be interested in that the core PCE price index rose at an annualized pace of 5.1% last month, up from 4.9% previously but less than 5.2, which is the ratio expected by economists.

While it may have been more telling, this was well below the 30 basis point increase in September in the official measure of core inflation, which rose from 6.3% to 6.6% when the Bureau of Labor Statistics announced it on Oct. 13. Commenting on this, Tim Quinlan, chief economist at Wells Fargo, says: “The main difference is that today's data does not indicate a new high cycle of core PCE inflation. This milestone was reached in February when it was 5.4%.”

Therefore, the British pound and other currencies rose after the publication, although the gains were limited, which may reflect a large profit taking that has already pushed most US dollar exchange rates lower for most of the week. Both of the different core inflation rates mentioned above remove energy and food from the basket of commodities whose prices are analyzed, since they are volatile and trade internationally, so they are believed to provide a better reflection of domestically driven inflation trends. When energy and food items were added to the basket, the official and PCE inflation rates were 8.2% and 6.2% higher, respectively, for the month of September. The PCE data was released Friday along with the third-quarter release of the employment cost index, which fell from 1.3% to 1.2% on a quarterly basis, and suggested wage increases moderated in most of the economy over the last quarter.

Wages and salaries grew at a slower annual rate than in the previous quarter for both civil and private industry workers while rising faster for state and local government employees, although wage growth in the public sector was lower than in the private sector and remained lower last quarter. None of this is likely to prevent the Fed from raising rates next Wednesday when many in the market are looking to see another three-quarters of a percentage point increase bringing the maximum Fed funds rate range to 4%, although this is well priced for the dollar exchange rates.

Sterling dollar forecast today:

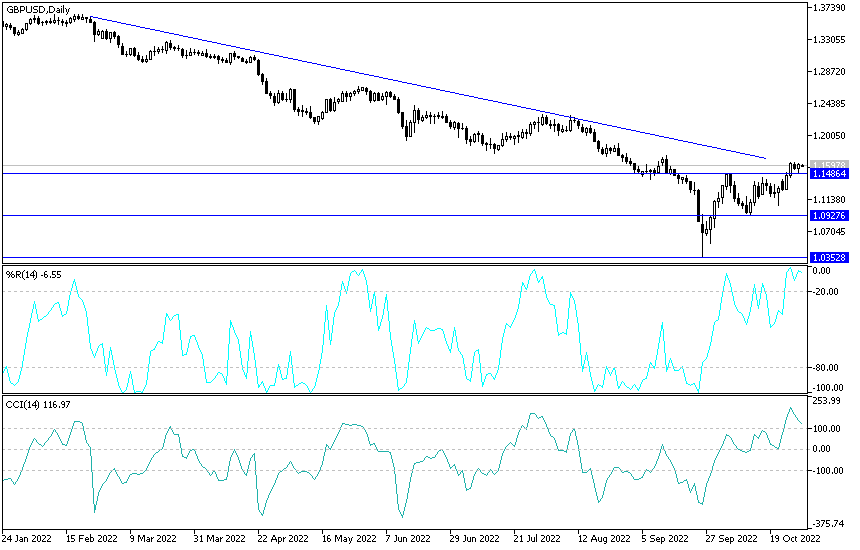

- According to the performance on the daily chart below, the price of the GBP/USD currency pair is still in the phase of breaking the bearish trend.

- The bulls still need to move more upwards, and the resistance levels 1.1665 and 1.1800 may be important to change the general trend to the upside.

- On the same time period, a move towards the 1.1390 and 1.1200 support levels will be important for the bears' return to control the trend.

- I still prefer to sell the GBP/USD from every ascending level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.