XAU/USD gold prices fell sharply at the beginning of this week’s trading, as prices fell from the $1700 resistance to the $1665 support level an ounce. The better-than-expected US jobs data released on Friday reinforced bets for a significant increase in interest rates from the Federal Reserve. The Federal Reserve is widely expected to raise US interest rates by 75 basis points for the fourth time in a row next month.

New York Fed President John Williams said last week that rates need to rise to about 4.5 percent over time to bring down inflation quickly. US inflation data, minutes from the Federal Reserve's September meeting and reports on retail sales and consumer confidence due this week will provide more insights into the view of policy makers on the inflation stance and expectations for the future path of interest rates.

The European Central Bank also saw an interest rate hike of another 75 basis points at its October meeting. Elsewhere, market experts are expecting a 100 basis point increase in the upcoming Bank of England (BoE) key rate decision.

Stocks are Falling

US stocks are falling on Wall Street ahead of the latest round of corporate earnings reports and a busy week of inflation updates. Accordingly, the S&P 500 Index fell 0.4%. The Dow Jones Industrial Average fell five points, or less, from 0.1 percent to 29,293 and the Nasdaq fell 0.6 percent. US bond trading was closed. The major indices are kicking off a volatile week with gains due to the two day early rally that shielded stocks from several weak days.

All in all, Wall Street was turbulent amid concerns about overheating inflation and the Fed's plan to tame high rates by raising interest rates. The goal is to slow economic growth and cool down borrowing and spending in order to control inflation, but the plan risks tipping the economy into recession. Investors are likely to get a more detailed picture of the Fed's thinking tomorrow, Wednesday, when the US central bank releases the minutes of its latest policy meeting. This was when the Fed made another big increase in interest rates by three-quarters of a percentage point.

Gold price forecast today:

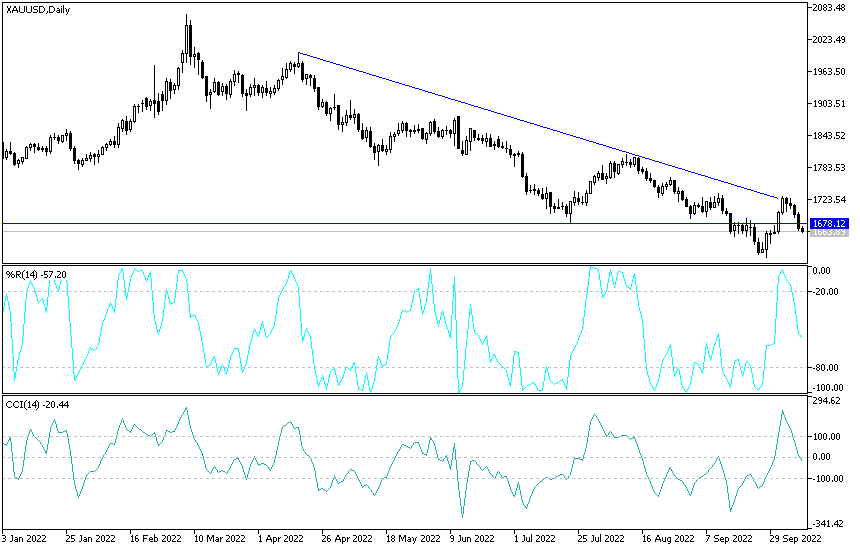

- According to the performance on the daily chart below the direction of the gold price XAU/USD turns to the downside as long as it is stable below the price of 1700 dollars an ounce.

- The continuation of the strength of the US dollar may give the bears the impetus to move towards stronger bearish levels and the closest ones are 1653 and 1640 dollars, respectively.

- It is appropriate to think about buying Gold without risk. It is enough to push the technical indicators towards oversold levels.

On the other hand, and over the same time period, the stability of the XAU/USD gold price above the $1700 resistance will be important for the bulls to control the trend again. I still prefer buying gold from every bearish level.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.