At the end of last week's trading, the price of XAU/USD gold declined to trade at a new weekly low at about $1,638 an ounce. At the beginning of this week's trading, it settled around its losses.

- The XAU/USD gold price is trading influenced by the results of the latest important US economic data, as the core PCE price index in the US for September missed expectations (on an annual basis) at 5.2% with a change of 5.1%.

- The change (MoM) of 0.5% was in line with expectations.

- On the other hand, personal income for the month exceeded expectations of 0.2% with a change of 0.4% (MoM), while personal spending exceeded 0.4% with a change of 0.6%.

Prior to that, US durable goods orders for September missed expectations at 0.6% with a 0.4% change. On the other hand, pre-defense durable goods orders topped 0% with a 1.4% change, while out-of-transport durable goods orders lost 0.2% with -0.5% change. Last week's initial jobless claims exceeded the expected claims count of 220K with a tally of 217K, while the previous week's continuing claims missed 1.388 million with the claims count of 1.438 million.

Technology stocks led a broad rally in Wall Street on Friday, capping another strong week for the market, as investors welcomed solid earnings from Apple and other companies. The S&P 500 Index is up 2.5% and posting its first consecutive weekly gain since August. The Dow Jones Industrial Average rose 2.6% and the Nasdaq Composite rose 2.9%. Shares of small US companies also rose, lifting the Russell 2000 Index by 2.3%. Apple's latest quarterly results showed the iPhone maker posted more profit over the summer than expected. Accordingly, its shares rose 7.6% and led a rally in technology shares that were largely defeated the previous day.

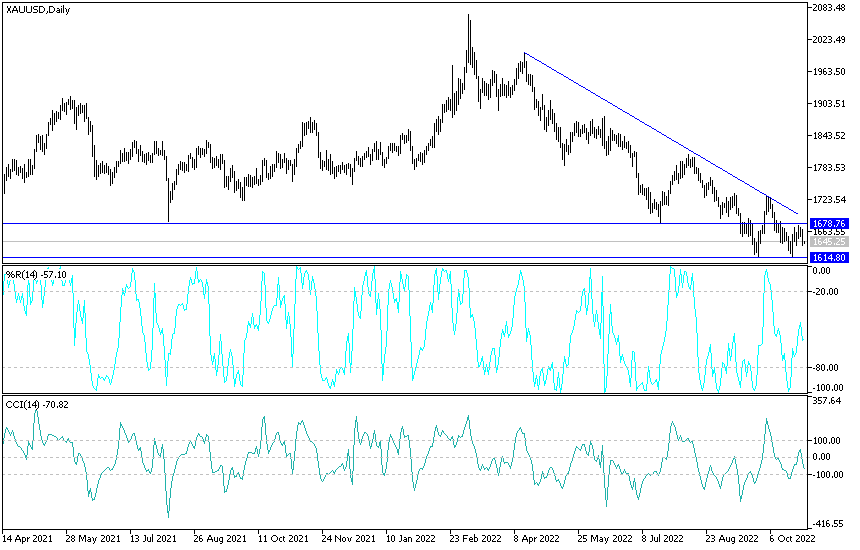

XAU/USD Technical Analysis:

In the near term and according to the performance on the hourly chart, it appears that the price of the yellow metal XAU/USD is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current series of declines towards $1,631 or lower to $1,618 an ounce. On the other hand, the bulls will look to pounce on potential retracements around $1,654 or higher at $1,662 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a slight long-term bearish momentum in the market sentiment. Therefore, the bears will target long-term profits at around $1,591 or lower at $1,513 an ounce. On the other hand, bulls will target potential recovery profits at around $1,728 or higher at $1,801 an ounce.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.