Gold retreated after rising above $1,700 an ounce with bouncing gains towards the $1,730 resistance. Gold then went back to settle around the $1,716 support level after testing the $1,700 level. This happened as traders weighed whether the US central bank might adjust from its tough stance after the release of weak US data.

The price of gold has returned to decline with the rise in the US dollar and Treasury yields, after rising nearly 4% in the previous two sessions. A worse-than-expected gauge of US manufacturing and lower US jobs helped push bullion prices higher through a key technical level, signaling a shift in market sentiment.

The weak data has raised expectations that the Fed may slow the rate hike path, which will increase the attractiveness of gold, which is not offering any interest. More employment data due this week could provide clues to the path of a possible tightening of the US central bank.

Commenting on the gold market. “The gold bottom is now in place as the US shows clear signs of a labor market pullback,” Ed Moya, chief market analyst at Oanda, said in a note. As long as US non-farm payrolls do not see "extraordinarily strong printing," the price of gold should remain supported and could test $1,750 an ounce, he said.

The focus will also be on Fed officials' reaction to the data. Neil Kashkari and Rafael Bostic speak, although they did not vote on monetary policy this year.

Stocks extending recovery

US stocks erased selling close to 2 percent earlier on Wednesday, extending their recovery from this year's low. According to the performance, the S&P 500 index rose for the third day in a row, with shares of the energy giants joining the gains in oil after the large OPEC + production cut. Investors also weighed new economic data and comments from Federal Reserve officials. Treasury yields rose with the dollar. Even the bears in the stock markets are still too afraid to be taken out of the market.

Investors got fresh economic insights, as data showed solid growth in US service providers and companies hiring at a solid rate. They also assessed comments from San Francisco Fed President Mary Daly, who sees a high benchmark for slowing the pace of gains of 75 basis points as she monitors data between now and the November meeting. Daly also said that the expectation of cuts next year is misplaced.

All in all, all eyes will now be on the US government jobs report on Friday which is expected to show another month of strong job creation and the unemployment rate stabilizing near a 50-year low. Wednesday's ADP employment report helped mitigate some of that "cautious atmosphere" that followed data showing a drop in job opportunities in the US, lending credence to the notion that the labor market could moderate.

As the US central bank ramped up the fight against inflation, a report released on Wednesday outlined the sudden swing in borrowing costs. As US mortgage rates jumped to a 16-year high of 6.75 percent, marking the seventh straight weekly increase, and spurring the worst decline in mortgage applications since the depths of the pandemic.

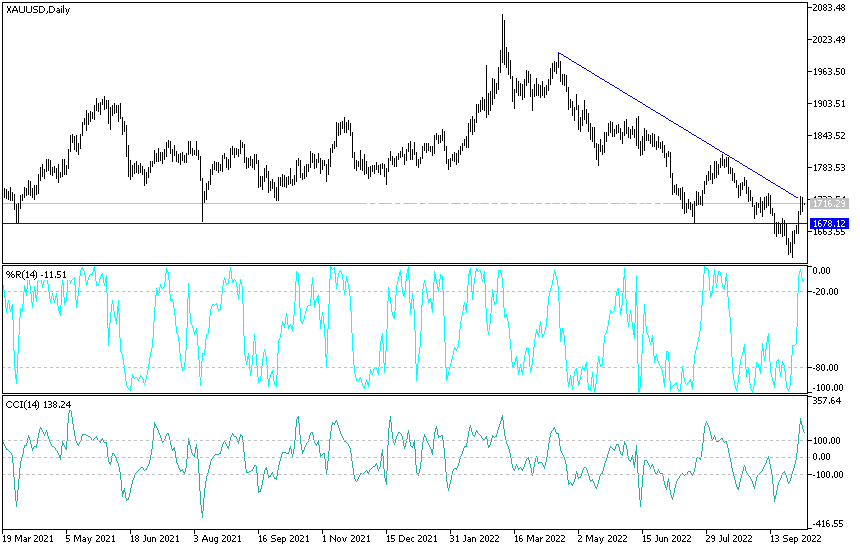

Today's XAU/USD Gold Price Forecast:

- The stability of the XAU/USD gold price above the psychological resistance of 1700 dollars an ounce is still important for the bulls to move higher.

- It can confirm the reversal of the bullish trend, as the bulls will move towards stronger ascending levels that were mentioned in the recent technical analyses of 1725 and 1748 dollars, respectively.

- According to the performance on the daily chart, the movement of the gold price towards the support level of 1680 dollars will be important for the bears to confirm that the downward path is the strongest and most continuous.

- I still prefer buying gold from every descending level, especially since the global central banks are giving signals to calm the tightening path.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.