Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

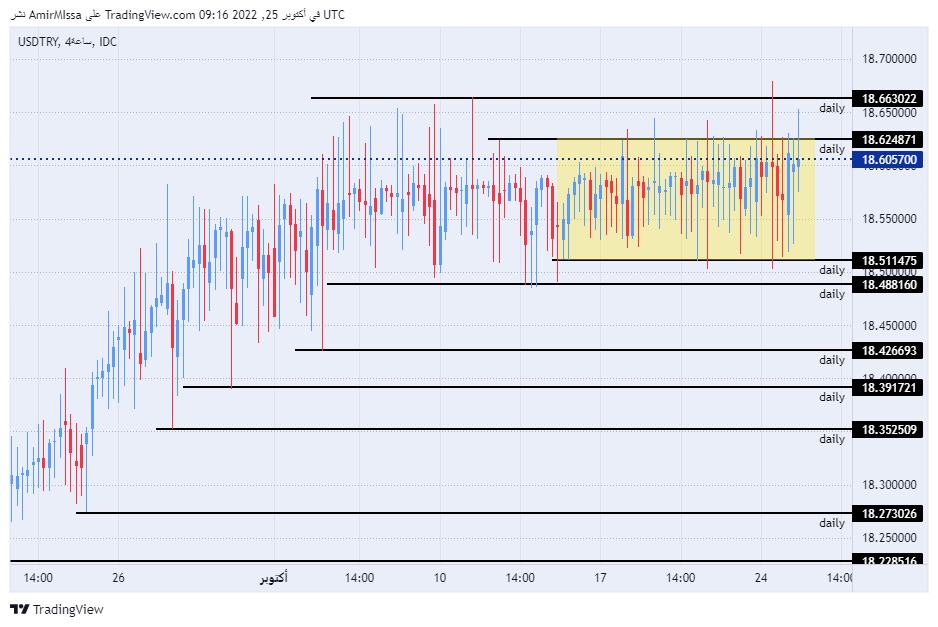

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.35 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The TRY/USD recorded new levels of declines after the dollar recorded new heights yesterday. This happened after the statements of the Turkish Finance Minister Nureddin Nabati to the Financial Time newspaper, where the Turkish minister defended the monetary and financial policy of the Turkish President, Recep Tayyip Erdogan. He said that his country is witnessing a stage, a shift, as the Turkish president's policy aims to boost domestic production, create jobs and increase exports.

The Minister of Finance attributed the foreign flows of capital to legal and legitimate sources, as he rejected accusations that his country facilitated the entry of funds from Russia. This would have contributed to filling a large part of the trade deficit in Turkey - where the Turkish minister attributed these flows of funds Turkish investors abroad, in addition to several billions from Russia, were transferred to the construction of a nuclear plant in the country. It is noteworthy that the economic situation in the country threatens the possibility of re-electing the Turkish president, which paves all ways to pass the presidential elections, which are expected to take place in mid-2023.

TRY/USD Technical Analysis

On the technical front, the Turkish lira fell against the US currency, as the pair set new records after rising above its previous high of 18.66, which was recorded during the current month. It recorded 18.68 before retreating in a strong movement. To continue trading within a narrow trading range for more than two weeks.

In the meantime, the pair is trading above the 50, 100 and 200 moving averages on the daily time frame, indicating the general bullish trend, while the pair is trading between these averages on the four-hour time frame. Also, on the 60-minute time frame, which shows the extent of volatility and trading in the narrow range that the pair is recording. The pair is trading the highest levels of support, which are concentrated at levels of 18.51 and 18.42, respectively.

On the other hand, the lira is trading below the resistance levels at 18.66 and 18.99, respectively. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.