- For five trading sessions in a row, the price of the USD/JPY currency pair continued to maintain its bullish momentum near its highest level in 24 years.

- Expectations of a stronger US interest rate hike and the results of US economic data confirm that the US Federal Reserve is on its way.

- The forces did not slow down as the markets had expected.

- The price of the dollar yen closed last week's trading around the resistance level 144.80, and from this level and higher, there was talk in the markets about the Japanese intervention.

USD/JPY Economic Data

Consumers in August spent a little more than the previous month, a sign that the US economy is holding up even as inflation rises in food prices, rents and other necessities. The US Commerce Department said on Friday that Americans boosted their spending in stores and on services by 0.4% in August, after declining by 0.2% in July. However, much of this increase reflects higher prices, as the closely watched inflation gauge by the Federal Reserve rose 0.3% in August, and the numbers indicate that the US economy is showing some resilience despite a sharp rise in interest rates, volatility, violent stock market, high inflation.

However, there were signs that price hikes are weighing on shoppers. Consumer spending, adjusted for inflation, is growing at a weaker pace. It increased at an annual rate of 2% in the April-June quarter. However, July and August data suggest spending growth is on track to slow to an annual rate of just 0.5% in the July-September quarter, economists said.

The US economy is expected to grow in the third quarter after contracting in the first six months of this year. But many economists lowered their forecasts after the spending report and now expect growth to be 1% or so at an annual rate. Americans are also saving less to keep up with higher prices. A report on Friday said the US savings rate was only 3.5% in August, well below pre-pandemic levels of about 8%.

There have been other signs of US consumer weakness lately, with used-car seller Carmax reporting a sharp drop in sales in the three months to August. The company attributed the decline to "affordability challenges" for consumers amid high inflation and rising interest rates. Compared to a year ago, prices jumped 6.2%, down from 6.4% in July but not far from a four-decade high in June of 7%. The figure was lower than the more well-known CPI, released earlier this month, which announced an 8.3% price increase in August from a year earlier.

These numbers were higher than expected and may make the Fed more likely to raise the US interest rate by another 0.75 percentage points at its next meeting in November. If so, this would be the fourth straight hike. The inflation figures in Friday's report are similar to those released earlier this month, with core prices rising more quickly than core inflation. Lower gas prices lowered overall inflation, while higher costs for housing, cars, and services such as health care and haircuts drove up basic prices.

Overall, the Fed is trying to keep inflation under control through a series of the fastest interest rate increases in four decades. It pushed the benchmark short-term interest rate into a range of 3% to 3.25%, the highest rate since early 2008, up from nearly zero in March. Fed Chair Jerome Powell and other officials have repeatedly emphasized the Fed's determination to cut rates, even if higher interest rates lead to layoffs and higher unemployment. The Federal Reserve intends to raise US interest rates to slow borrowing and spending, which in turn will reduce inflationary pressures in the economy. Inflation has risen globally, contributing to economic and financial turmoil in the UK, Europe, and a large number of developing countries, from Turkey to Argentina.

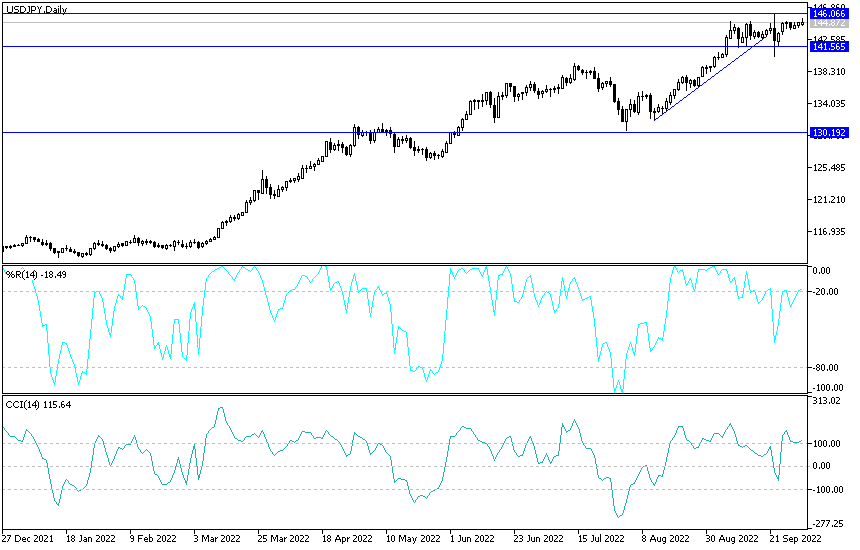

Technical analysis of the dollar against the yen today:

In the near term and according to the performance on the hourly chart, it appears that the USD/JPY pair is trading within a neutral channel formation. This indicates that there is no clear directional momentum in the market sentiment. Therefore, the bulls will target short-term profits at 145.37 or higher at the resistance 145.92. On the other hand, the bears will look to pounce on a potential pullback at around 143.93 or lower at the 143.28 support.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY pair is trading within the formation of a sharp bullish channel. This indicates a strong long-term bullish momentum in the market sentiment. Therefore, the bulls will look to ride the current rally towards 147.51 or higher to 150.16 resistance. On the other hand, the bears will target long-term profits at around 141.80 or lower at the 139.05 support.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.