The core measure of US inflation accelerated in September, while consumer spending remained resilient, indicating broad price pressures and strong demand strengthening the Fed's stance to raise US interest rates again this week. Ahead of the most important event for the US dollar in the coming days, the price of the USD/JPY is settling around the resistance level 148.00, recovering from last week's selling that pushed it towards the support level 145.10.

Overall, Friday's Commerce Department data showed that the PCE price index excluding food and energy, a key measure of core inflation tracked by the Federal Reserve, rose 0.5% from the previous month. A year ago, the measure rose 5.1%, up from the previous month, though slightly less than economists had expected. The overall PCE price index rose 0.3% in the month and rose 6.2% from a year ago, still well above the US central bank's 2% target.

The median estimate in a Bloomberg survey of economists was for a 0.5% monthly increase in the core PCE price index and a 0.3% advance in the overall measure. Stock futures and US Treasuries remained lower after the report.

Purchases of goods and services, adjusted for price changes, rose 0.3% stronger than expected last month after similar gains in August. The gain reflects increased spending on both goods and services. Similar to the CPI data released earlier this month, the latest figures underscore the severity and breadth of inflation in the US. It also explains why Fed policy makers are seeking to bring inflation back to its 2% target and are likely to raise US interest rates by another 75 basis points at this week's meeting.

The robust labor market, strong wage earnings and savings have helped families afford higher prices for everything from groceries to rent. However, it is unclear how long consumers and their money will be able to hold out. The Commerce Department report showed the savings rate fell to 3.1% in September, just above the lowest rate since 2008. Some businesses report changes in consumer behavior — from trading to buying less — and a recent Census Bureau survey found that four out of 10 households said it was somewhat difficult to cover the usual family expenses.

A separate report released Friday showed that the employment cost index, a broad measure of wages and benefits that Fed officials closely monitor, rose 1.2% in the third quarter of the previous three months. Sustained wage increases have been an ongoing challenge for the Federal Reserve in its quest to control rapid inflation.

Overall the Fed is in the midst of its most aggressive tightening campaign since the 1980s, which has notably affected the housing market but has not had a significant impact on the pace of inflation. However, the rapid pace of US interest rate hikes will weigh on the labor market and further slow the broader economy in the coming months. It is likely that central bankers will soon discuss when it is appropriate to slow the pace of increases.

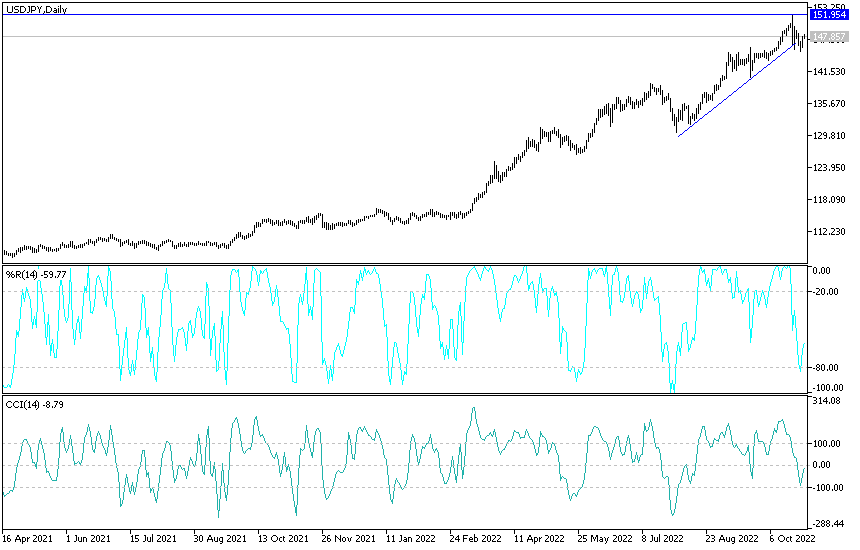

USD/JPY Technical Analysis:

- In the near term and according to the performance on the hourly chart, it appears that the USD/JPY is trading within an ascending channel formation.

- This indicates a significant short-term bullish momentum in market sentiment.

- Therefore, the bulls will look to ride the current rally towards 148.21 or higher to 148.89 resistance.

- On the other hand, the bears will look to pounce on a potential pullback at around 146.73 or lower at the 145.97 support.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY pair is trading within the formation of an ascending channel. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls will target long-term profits at around 149.94 or higher at the 151.89 resistance. On the other hand, the bears will target a potential pullback at around 145.04 or lower at 142.23 support.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.