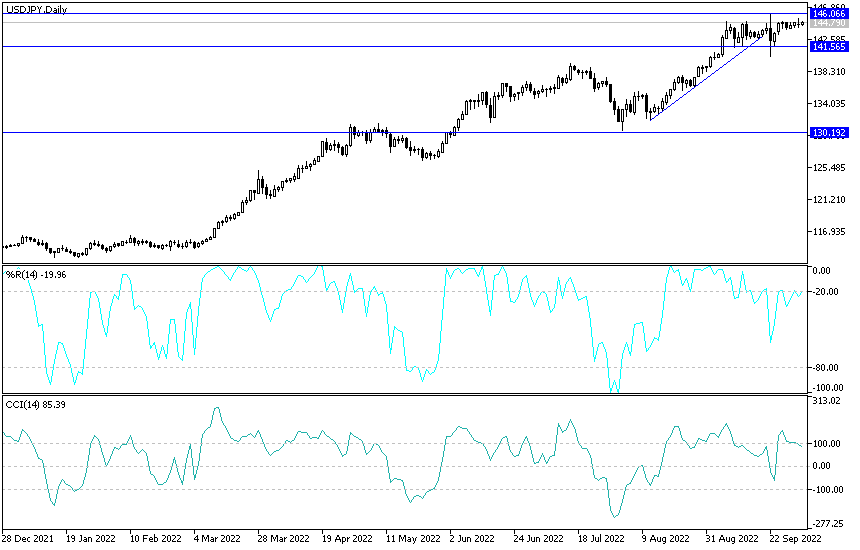

At the beginning of this week's trading the Japanese yen slipped again to break the 145-high threshold against the dollar, paving the way for the Japanese authorities to intervene to support the currency for the second time this year. The USD/JPY currency pair rose towards the resistance of 145.31, its highest level in 24 years, before being exposed to a quick profit-taking process, reaching the 144.15 support level and settling around the 144.50 level at the time of writing the analysis.

The Japanese currency has fallen, extending its decline this year to 21%. The Japanese yen had fallen to a 24-year low of $145.90 on September 22nd before policy makers decided to intervene to contain the losses. The decline in the Japanese yen highlights the authorities' struggle to support the currency as the Bank of Japan maintains a accommodative policy even as the Federal Reserve raises US interest rates. The Ministry of Finance spent 2.84 trillion yen ($19.6 billion) in September to slow its slide.

Commenting on the performance, Christopher Wong, an Overseas analyst, said China Banking Corporation officials may intervene, "but history suggests that the impact may be short-lived unless the intervention is coordinated." For his part, Japanese Finance Minister Shunichi Suzuki said before the yen slipped from 145 on Monday that the government remains ready to take necessary responses to excessive forex market movements. The ministry said Japan had $1.29 trillion in foreign exchange reserves as of August.

Investors are now watching for a possible breakout of 147.66, which could take the yen to its weakest level since 1990. When Japan intervened to support the yen in 1998, the country did not act unilaterally because the US was also involved in selling the dollar.

Economic Outlook

The gauge of US manufacturing stumbled in September to its lowest level in more than two years, approaching a full recession as orders contracted for the third time in four months. According to the official announced, the measure of factory activity of the Institute of Supply Management ISM fell by nearly two points to 50.9, the lowest level since May 2020, and the 50 reading separates growth from contraction, and the September result was weaker than the average projection of 52 in a Bloomberg survey of economists. The PMI's measure of new orders fell more than 4 points to 47.1, also the lowest level since the early months of the pandemic and a sign of waning demand. Consumer spending on goods is stabilizing, and while business investment in equipment has stalled, economic growth concerns are growing as the Federal Reserve raises interest rates to combat inflation.

Nine industrial industries posted growth in September, led by metal products, machinery and plastics. Seven industries reported a contraction, including furniture, textiles and lumber. Meanwhile, the measure of prices paid for materials used in the production process declined for the sixth month in a row. At 51.7, the price index is the lowest since June 2020, likely reflecting the decline in oil, metal and other commodity prices due to global recession fears. The ISM index of export orders was contracted the most in more than two years.

As consumers shift more of their discretionary income toward services and away from goods, manufacturers are finding the means to offset the backlog of demands. The accumulated ISM metric has fallen to its lowest level since 2020. This eases pressure on supply chains, as evidenced by the decline in the ISM indicator of supplier delivery. Shipping times have been extended, but at the slowest pace since December 2019 - before the pandemic.

Forecast of the dollar against the Japanese yen today:

- The recent moves still confirm our expectations that the general trend of the USD/JPY pair is to the upside.

- Any decline in the currency pair due to profit-taking operations may be an opportunity to consider buying, as the US dollar is still stronger with expectations of raising US interest rates and positive results of the latest US economic data.

- According to the current performance, the closest resistance levels for the current trend will be 145.20 and 146.30, respectively.

- This is unless there are Japanese signals of a new intervention, the currency pair may complete the current upward trajectory.

On the other hand, according to the performance on the daily chart, there will be no breach of the current trend without a break below the 142.00 support level. The trend will remain as it is until the US job numbers are announced by the end of the week.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.