The ascending path of the USD/JPY currency pair was not affected much by the selling that the currency pair witnessed in the middle of this week’s trading. It moved towards the support level 143.52 amid the bulls’ control. The currency pair returned in the broader path towards the resistance level 144.70. As mentioned before, the gains of the dollar-yen will remain valid until the reaction to the US job numbers tomorrow, Friday. The job numbers have a direct reaction to the expectations of raising US interest rates, the direct cause of the US dollar's gains towards its highest level in 20 years.

According to analysts, the USD rally appears to be extended further and we believe there is room for further consolidation. With Fed officials continuing to beat their hawkish drums, the main underlying driver of dollar strength remains and the risk of the self-reinforcing dollar continuing to melt away. In this regard, analysts at investment bank Nomura say in a recent note, “The simple fact is that the recent surge of the US dollar is effectively 'exporting US inflation to the rest of the world,' and it has repeated the old 'our currency, your problem' dynamic, causing enormous stresses economically...

Global Environment Facing Wall of Anxiety

The Fed should signal that it is willing to slow the hiking cycle to relieve the stress. In the middle of this week's trading, the exchange rates of the US dollar fell in front of everyone, after the release of data indicating that the number of vacancies in the United States fell sharply in August.

Reducing historically high corporate demand for labor has been a key objective of the Federal Reserve (Fed) in its attempt to bring US inflation back to the 2% target after wage growth rates began to pick up dramatically in response as well as energy and food price increases seen in recent years. That's why FOMC members may feel encouraged after the Bureau of Labor Statistics (BLS) said Tuesday that US job vacancies fell from 11.17 million to 10.05 million over the course of August.

The Monthly Employment and Employment Turnover Survey (JOLTS) states that “the largest declines in employment were in health care and social assistance (-236.000), other services (-183,000), and retail trade (-143,000). She added, "The number of appointments did not change much at 6.3 million, and the rate did not change at 4.1 percent. And appointments to the federal government are down.”

The US data relates to the month before the Federal Reserve raised its interest rate by three-quarters of a percentage point for the third time in a row, raising the federal funds rate to between 3% and 3.25% for the month of September in a decision that was accompanied by warning predictions of upcoming increases. The September forecast suggests rates could rise as much as another 1.25% in 2022 to put the fed funds rate in a range between 4.25% and 4.5% before rising again to between 4.5% and 4.75% sometime in 2023. Commenting on the numbers. “In one line: The first clear sign of weak labor demand will pressure the Fed to do less, if it continues,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

If it continues over the next few months, and core inflation drops as much as we expect, the Fed will not raise 125 basis points by the end of the year. Our base case is 100 basis points, but now you can't judge 75 basis points or even 50 basis points.

Dollar exchange rates built more on previous losses after the data while US government bond yields began to reverse earlier increases in results that provided additional easing to other currencies and bond markets around the world. Tuesday's US job vacancy data came on the heels of Monday's release by the Institute for Supply Management (ISM) of its September manufacturing Purchasing Managers' Index, which recorded its biggest drop in a number of months before settling at its lowest level since May 2020 in another indication that slowing US economy.

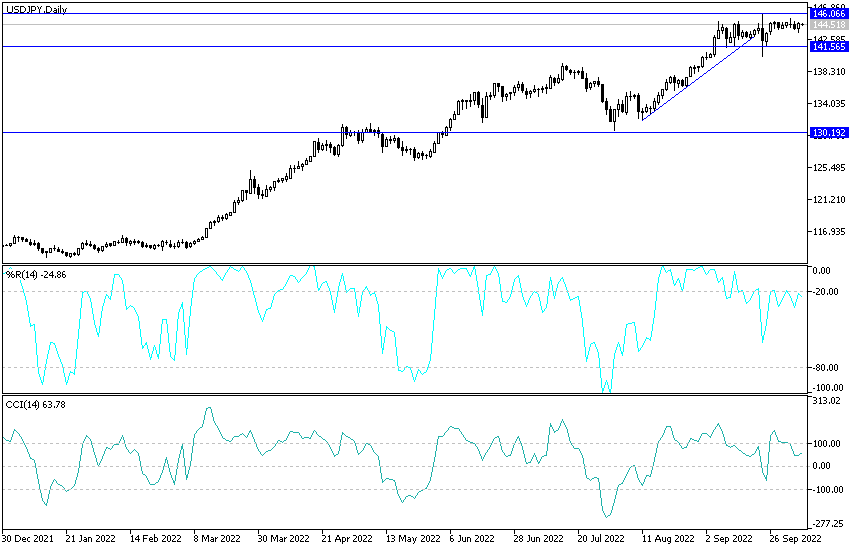

Forecast of the US dollar against the Japanese yen today:

- Despite the recent selling operations, the general trend of the USD/JPY currency pair is still bullish.

- It ignores the technical indicators' arrival towards overbought levels, as the dollar's gains factors are still valid.

- It must be taken into consideration that the breach of the psychological resistance level of 145.00 will bring the markets more talk about a new Japanese intervention in the markets to avoid further collapse of the Japanese yen.

On the other hand, the support level 142.00 was broken, which is important for more bears' control and turned the general trend to the downside.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.