- At the end of trading last week, with the decline in the price of the US dollar, Gold prices rose towards the resistance level of $1657 an ounce after a strong downward journey in prices towards the support level of $1617 an ounce.

- With this decline, I recommend buying gold from each descending level.

- Gold prices fell significantly during the week's trading, affected by rising bond yields and concerns about violent policy tightening by the US Federal Reserve.

- Gold prices were affected by hawkish comments from Philadelphia Federal Reserve President Patrick Harker that rate hikes will continue for "some time" to combat inflation.

According to economic analysis, the Gold price is trading affected by the announcement that US initial jobless claims for the week ending October 14th exceeded the expected claims number at 230K with a statistic of less than 213K. On the other hand, continuing claims for the previous period beat expectations of 1.375 million with a tally of 1.385 million, while the Philadelphia Fed Manufacturing Survey for October beat the expected reading of -30 with a reading of -26.7.

Prior to that, US Building Permits for September were announced outperforming the expected figure (MoM) at 1.53M with a total increase of 1.564M. On the other hand, housing starts during the period missed the expected (monthly) number of 1.475 million with 1.439 million.

The price of gold continues to decline in the long term amid a more positive outlook for the market in the long term. For their part, US central bankers said that the next stage in their campaign to curb inflation will be to discuss how high US interest rates should be and when to slow the rate increases. Louis Fed President James Bullard and San Francisco Fed President Mary Daly emphasized the need to continue tightening policy with inflation at a 40-year high, suggesting more caution next year.

Their comments in separate events Friday come as officials are about to enter a blackout period ahead of their November 1 and 2 political meeting. Both indicated that they expected the discussion to be on the table at that meeting.

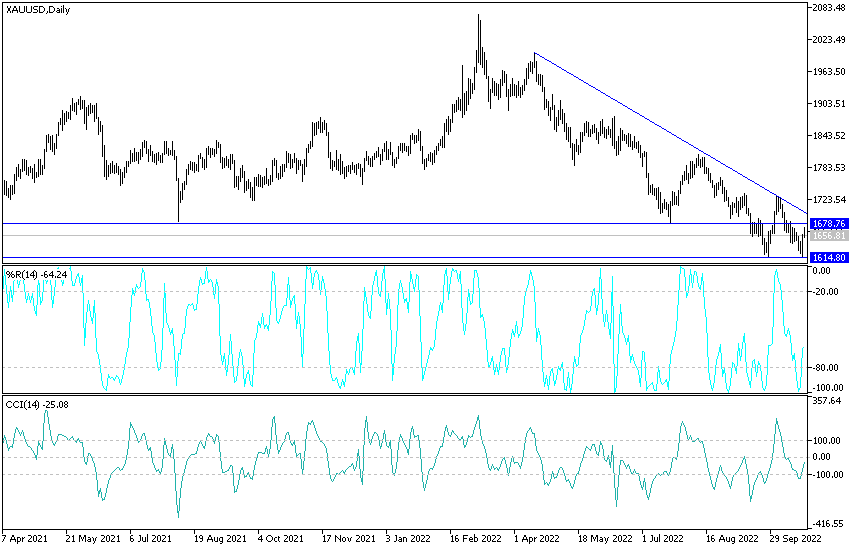

Gold Technical Outlook

In the near term and according to the performance on the hourly chart, it appears that the gold price has recently completed an upward breach of the descending channel formation. This indicates a significant change in market sentiment from bearish to bullish. Therefore, the bulls will target the extended rebound profits at around $1,676 or higher at $1,697 an ounce. On the other hand, the bears will target potential pullbacks around $1,640 or lower at $1,623 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current declines towards $1,591 or lower to the $1,513 support an ounce. On the other hand, bulls will target long-term profits at around $1,728 or higher at $1,801 an ounce.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.