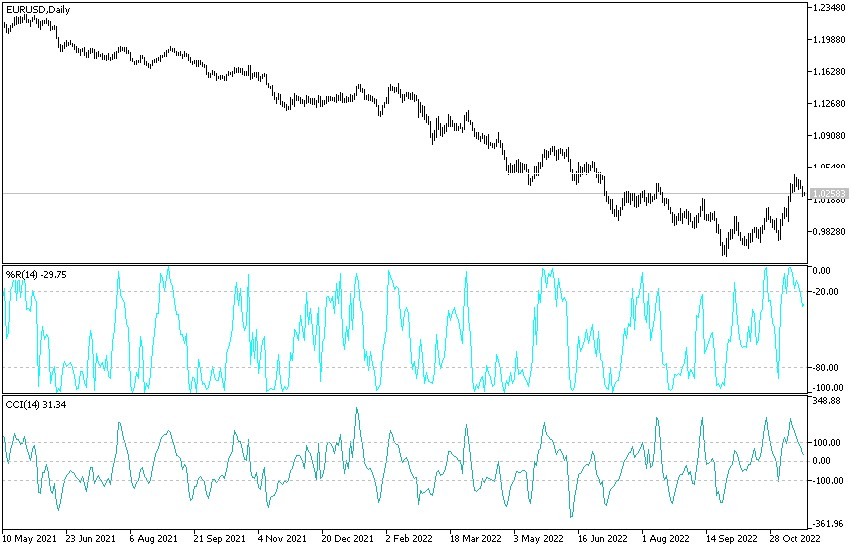

For three consecutive trading sessions, the price of the EUR/USD currency pair has moved in a downward correction range, reaching the support level of 1.0222. So far, the euro is still on the rise, amid improved technical preparation, expectations of the European Central Bank raising interest rates, and the broader decline in the dollar.

The EUR/USD exchange rate rose to a multi-month best of 1.0481 last week, ahead of the recent sell-off. Commenting on the currency pair's performance, a note from the currency trading desk at JP Morgan reads, “I feel it will need some decent improvement to get the euro to rally again from here. A close above 200 days coming now at 1.0410 now would be a positive sign, a return below 1.0270 would have the short-term bulls capitulate.” However, short-term technical indicators are still supporting the EUR/USD which is now 5.0% higher than it was a month ago, confirming that the near-term trend favors the upside.

For his part, Sean Osborne, Forex Analyst at Scotiabank, says that the short-term studies of EUR/USD are bullish. “Short-term (bullish pennant) trading patterns indicate that EUR/USD is consolidating before a renewed push higher,” he added. Scotiabank analysts believe that short-term trends and momentum are positives for the EUR, and this position could challenge the rebound resistance at 1.05 lows in this week or so.

The main data event for the EUR this week is the release of the Eurozone PMI for November, which is due out on Wednesday at 9:00 GMT. Manufacturing PMI is expected at 46.0, down from 46.4 in October; The Services PMI is expected at 48.1, down from 48.6 in October and the Composite PMI is expected at 47.0, down from 47.3.

For his part, Valentin Marinov, forex analyst at Credit Agricole, says: “We see increased downside risks for EUR/USD from current levels ahead of Eurozone PMIs for November.” The economic data will inform market expectations of the number of potential rate hikes coming from the European Central Bank (ECB), with stronger-than-expected data likely to support expectations of a rate hike.

For her part, Christine Lagarde, President of the European Central Bank, made it clear before the weekend that there is more work to be done on interest rates, stressing that the central bank is not ready to consider slowing the pace of increases. In a speech in Frankfurt, she said: “We expect interest rates to rise further - and withdrawing facilities may not be enough. Ultimately, we will raise rates to levels that bring inflation back to our medium-term target in due course.”

As long as the ECB's interest rate hike expectations remain elevated, backed by such commentary from the ECB, the euro could receive some degree of support.

For the dollar, the week will be short due to the Thanksgiving holiday, which begins on Thursday. Before that, a number of Fed governors will try to warn markets that the rate hike cycle is far from over, in order to try to ensure that the latest relief rush does not ease financial conditions. However, recent unwinding efforts by Fed members failed to have a lasting impact on the greenback, suggesting that markets are now well prepared for a slowdown in a rate hike cycle that will see a turn lower to a 50bp hike in December.

Euro predictions against the dollar today:

- With the recent selling operations, the price of the EUR/USD currency pair may move in the stage of breaking the general bullish trend.

- This in case the tone of the US Federal Reserve minutes this week is more stringent, and the break may occur if prices move towards the support levels 1.0175 and 1.0090, respectively.

- I still prefer to sell the EUR/USD from every bullish level.

- On the other hand, according to the performance on the daily chart, the retest of the psychological resistance 1.0400 will be important for the bulls to control the trend again.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.