Amid a cautious wait, the GBP/USD currency pair may take significant cues from the Bank of England's decision to be released later in the week, as the BoE may choose to be more aggressive with its tight moves. The British economy is facing persistent inflation and weak growth, so policy makers may decide to announce a larger rate hike to control price pressures.

Today, the sterling dollar is settling around the 1.1511 level. Meanwhile, the FOMC decision and the US non-farm payrolls report are likely to have a significant impact on the dollar pairs later in the week. The Federal Reserve could raise US interest rates by another 0.75% and indicate scope for further rate increases, which could be bullish for the dollar.

However, deciding to reduce the pace of tightening could undo more of its gains. Also, there is another slowdown in hiring, which could cast doubt on future price hikes.

The dollar is expected to remain in control and put an end to the recent recovery of the pound by analysts at Bank of America, who say that any near-term Fed "pivot" is not a game changer in the global forex. The GBP/USD exchange rate ended in October with a sharp percentage decline, and the decline came just days before the important midweek meeting of the US Federal Reserve, where a 75 basis point rate hike is likely.

October however was a month to recover for the pound, as the GBP/USD pair rose 3.0%, reaching 1.1646 on October 27.

Much of this improvement can be attributed to the disapproval of economic policies by Liz Truss and her advisor Kwasi Koarting, but expectations for policy changes at the US Federal Reserve have played a large role in the dollar's decline. The dollar was sold off last week after expectations increased that the Fed would be more cautious and that it might be time to slow the pace of rate hikes. Expectations of such a pivot were raised after an article in the Wall Street Journal and comments from Federal Reserve Chair Mary Daly suggesting that Fed officials would want to "step back" from the pace of rate hikes.

The dollar fell and stock markets rose as investors sensed a possible policy shift, but a major investment bank and lender says that although the Fed may reduce the pace of interest rate hikes, the dollar will maintain its strength. “We are looking at a 75 basis point rate hike," says Michael Gabin, US economist at Bank of America. We expect the president to open the door to a slower pace of gains beginning in December.” "However, we expect the Fed to remain data-driven and cumulative policy tightening will confirm any step back in pace," he adds.

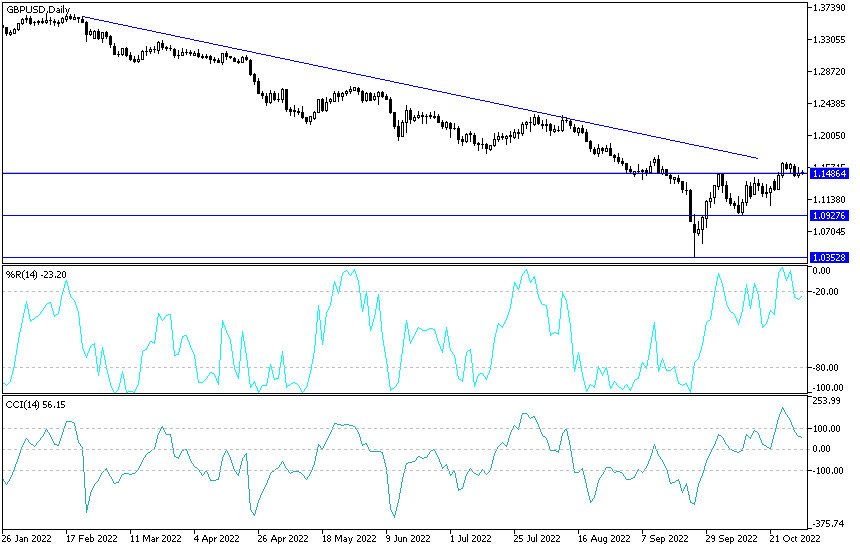

Sterling Dollar Technical Analysis

- GBP/USD is forming a new ascending channel on its short term time frames, and it looks like another test of support is about to happen.

- The price bounced off the top of the channel around 1.1660 and got a little closer to the 38.2% Fibonacci level.

- This retracement level lines up with the important channel mid-zone around 1.1440, which might be enough to keep losses in check.

- The biggest retracement might reach 61.8% Fibonacci near the key psychological support 1.1300 and the dynamic 100 SMA inflection point.

The 100 SMA is above the 200 SMA to confirm that the general trend has a chance to rise and that the support is more likely to hold rather than break. In that case, GBP/USD could make its way back to the swing high or channel top near 1.1700 after that. The stochastic is already in the oversold territory to indicate that sellers are exhausted, so a shift higher means buyers are taking over. On the other hand, the RSI has more room to head down before reaching the oversold area, so the price can follow suit.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.