Can the pound sustain its gains in light of a possible recession? The recent bullish retracement gains of the GBP/USD pair reached the 1.1855 resistance level, the highest for the pair in two and a half months.

According to the Office for National Statistics (ONS), the British economy contracted - 0.2% in the third quarter, the first decline in 18 months. But the figure was less than the market estimate of -0.5%. Data from the Office for National Statistics shows that the negative GDP growth rate was driven by a halt in the service sector, lower household spending, and shrinking business investment. Experts say this could be the start of the country's longest recession since records began. The Bank of England (BoE) expects the British economy to contract in the second half of 2022, continuing until 2023 and the first half of 2024.

Among other economic data, British industrial production held 0% in September, manufacturing production rose 0.2%, and construction orders advanced 5.7% year-on-year in September. Moreover, home prices fell 0.4% in October for the second month in a row, while retail sales rose at an annualized pace of 1.2% in October. Accordingly, Martin McTag, president of the Small Business Federation, described the latest economic figures as "terrible news." He added to BBC News: "Low levels of reserves and resources mean they are more vulnerable to a downturn, and at a time when confidence in both consumers and businesses is deteriorating, the outlook for the UK economy is now very bleak indeed."

Accordingly, the UK government bond market witnessed confirmed returns by the end of the week's trading, as the 10-year yield jumped 6.5 basis points to 3.352%. The three-month yield rose 5.1 basis points, while the 30-year bond yield rose 6.7 basis points to 3.471%.

Overall, the US dollar suffered its deepest one-day decline in more than a decade after weaker-than-expected US inflation data, a move that facilitated an unprecedented 3.15% advance in the GBP/USD exchange rate. Short-term momentum may extend as analysts say this “short-term” currency pair may rise amid more profit-taking and unwinding.

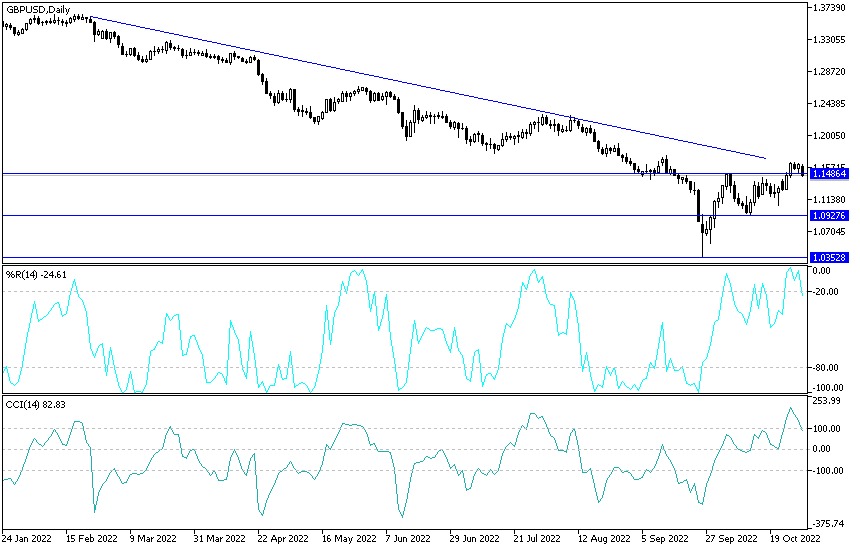

Technical analysis of the GBP/USD pair:

- In the near term and according to the performance on the hourly chart, it appears that the GBP/USD currency pair is trading within an ascending channel formation.

- This indicates a significant short-term bullish momentum in market sentiment.

- Therefore, the bulls will look to ride the current rally towards 1.1938 or higher to 1.2042 resistance.

- On the other hand, the bears will target short-term profits at around 1.1752 or lower at the 1.1645 support.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of an ascending channel. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls will target long-term profits at around 1.2186 or higher at the 1.2561 resistance. On the other hand, the bears will look to pounce on profits at around 1.1499 or lower at the 1.1124 support.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.