The performance of the British pound this week will look to maintain the previous week's rise of 4.0% against the US dollar, its largest advance since March 2020. This is the period when markets were recovering from the initial panic of the spread of the Corona virus. The recent rebound gains for the GBP/USD currency pair reached the 1.1854 resistance level, the highest for the currency pair in two and a half months and settled around the 1.1770 level at the time of writing the analysis. The pound awaits a package of economic data and important and influential measures.

- The bulk of the GBP/USD appreciation was reduced to a broad sell-off in the dollar and broad market relief following the release of lower-than-expected US inflation data.

- The US inflation reading showed that price pressures were declining in a number of sectors, which may indicate that inflation has peaked.

- This, in turn, suggests that the US Federal Reserve could consider easing the rate-raising cycle, indicating that the source of last months' support for the US dollar is coming to an end while relaxed markets no longer demand the safety that this currency has traditionally provided.

In contrast, the British pound is considered a "high beta" currency, which means that it tends to rise when global markets are rising, as was certainly the case after an inflation reading. As for the dollar, “further declines cannot be ruled out in the short term as markets get rid of long dollar positions,” says Thanem Islam, markets analyst at Equals Money. Also, a daily research note from TD Securities says: “While we believe this pressure is severe, and a pullback is expected in the short term, it is clear that the market is at a crossroads. We see a bit of a tendency to move forward with that.” This could extend in the coming weeks until the next CPI report.

This week can be determined by events in the UK as the heavy spreadsheet meets an important fiscal policy update from the new UK government. Tuesday sees wages and employment data released, with the market consensus looking for the average income index, with bonuses included, to rise 6.0% in September. The country's unemployment rate is expected to remain unchanged at 3.5% but job losses are expected to be reported at 155K during the three months to September.

If the British data disappoints, the British pound is expected to fall. However, Wednesday's UK CPI inflation is expected to be of greater significance to the Pound Sterling, as it has a direct impact on the future of the Bank of England's interest rate decision-making. Headline CPI inflation is expected to come in at 10.6% year-on-year in October, up from 10.1% in September.

The core CPI reading is seen at 6.4%, well ahead of the Bank of England's 2.0% target and in line with further rate hikes. It’s hard to predict how sterling will react to this data: will it rise due to weak inflation, as this suggests that the economic pain from inflation will be less severe? Or is it declining because the print of weaker inflation suggests that the BoE can end its rate-raising cycle soon?

The uncertainty comes as the pound's relationship to interest rate expectations shifts through 2022, thanks to the turmoil that followed the ill-fated budget of Liz Truss and Kwasi Karting. At the time, the Bank of England's rate hike expectations were consistent with the pound's weakness, while the long-term rule is that higher interest rate expectations support the currency. This breakdown in the relationship between sterling and rates reflects the risk investors have seen in the UK outlook due to Truss' unfunded tax cuts. Thus, this week's reaction will be important as it should indicate what matters to the pound again, and whether or not the gear-karting risk premium is gone.

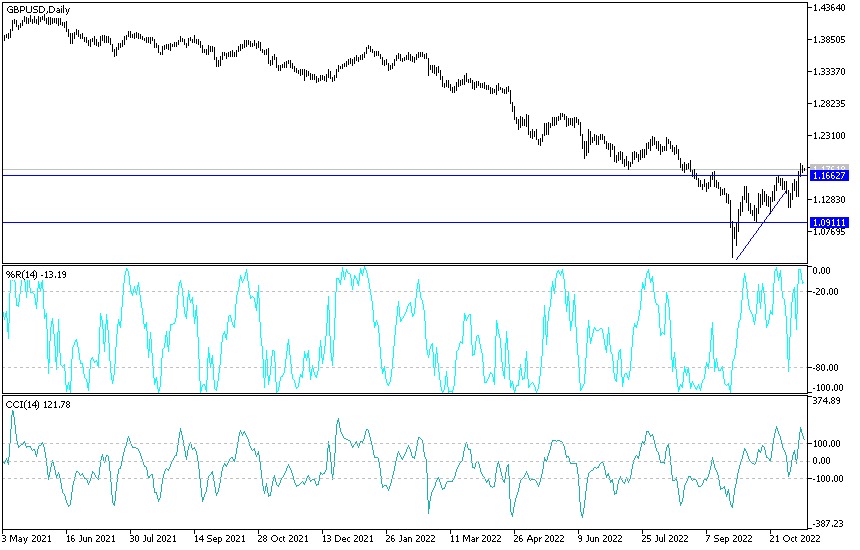

Technical analysis of the sterling against the dollar today:

GBP/USD is trending higher within a bullish channel visible on its short term time frames. The price is currently testing the resistance and it may be due to the decline to the support levels marked by the Fibonacci retracement tool. The 38.2% level is near the interesting mid-channel zone around the 1.1600 key psychological mark. The biggest pullback could reach the 50% mark at the 1.1500 mark or the 61.8% Fibonacci level at 1.1412, near the dynamic 100 SMA support.

The dynamic 200 SMA inflection point lines up with the channel bottom near 1.1300 and the line may be in the sand for a pullback. A break below this could result in a reversal of the uptrend. So far the 100 SMA is above the 200 SMA to indicate that the general trend is to the upside and that the support levels are more likely to hold than break. In that case, GBP/USD could soon find its way to a swing high of 1.1856 or higher. The stochastic is currently indicating overbought or exhaustion levels among the buyers, so a shift to the downside means the sellers are in control. The oscillator has plenty of room to move down before reaching the oversold area. Similarly, the RSI is just beginning to decline, reflecting a recovery in selling pressure.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.