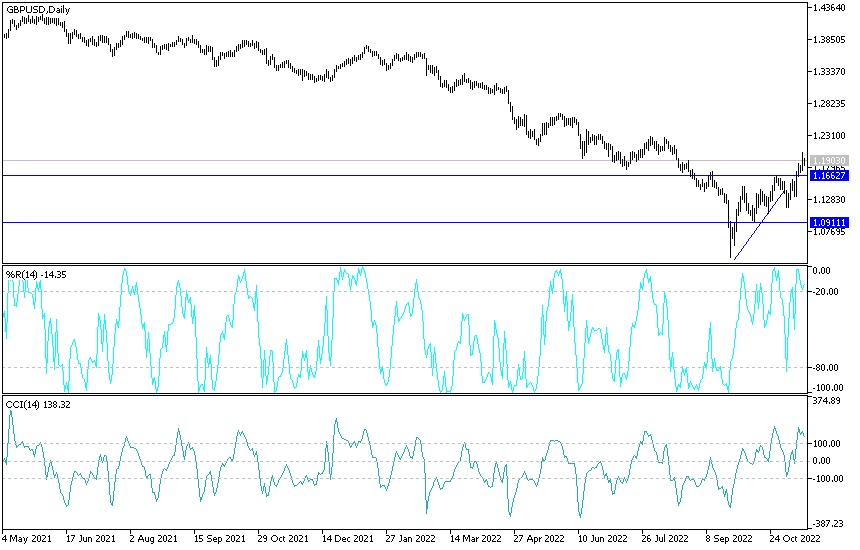

Despite announcing the rise in British inflation to its highest level in 41 years, the GBP/USD stopped the upward path at the 1.1942 resistance level.

- On Tuesday it was the strongest, with the currency pair reaching the 1.2030 resistance level, its highest in three months.

- The sterling dollar pair stabilizes around 1.1890 at the time of writing the analysis, waiting for any new news.

- All in all, higher-than-expected UK inflation pushed higher-than-expected energy bills to a 41-year high in October, piling pressure on the government and the Bank of England to act.

According to official figures, the British consumer price index rose to 11.1% compared to last year, according to what was reported by the Office for National Statistics. That was higher than the Bank of England's forecast for inflation to peak at 10.9% and more than five times the BoE's target of 2%.

Chances increase that BoE will raise rates again

British Prime Minister Rishi Sunak said controlling inflation is the primary goal of his government, in the latest hint that the Treasury will curb its spending quickly even though the economy is heading into recession. "People's number one concern right now is the rising cost of living, it's inflation," Sunak said Wednesday at a meeting of G20 leaders in Bali, Indonesia. And "we're going to have to make some tough decisions at home to protect ourselves from these and start to get inflation under control."

The numbers contrast with expectations in the United States, where speculation is growing that inflation may have peaked, allowing the Federal Reserve to slow rate hikes. Russia has cut natural gas supplies to Europe since its attack on Ukraine, driving up the cost of electricity in wholesale markets across the region.

British monetary policy makers led by Governor Andrew Bailey, who will testify before parliament later, said they were ready to aggressively raise borrowing costs to prevent a rise in prices. The pound rose 0.3% after the release before quickly erasing gains. Money markets are adding as much as 10 basis points to the bullish bets, pricing interest rates to peak around 4.65% by August. For his part, British Finance Minister Jeremy Hunt said he would help the Bank of England bring inflation back to target by taking "tough but necessary" measures to curb the Treasury's budget deficit. He blamed Russian President Vladimir Putin's invasion for "increasing inflation around the world".

"This insidious tax is decimating paychecks, family budgets and savings, while thwarting any opportunity for long-term economic growth," Hunt added in a statement. and “we cannot have long-term, sustainable growth with high inflation.” Higher energy prices were the biggest contributor to last month's inflation figures, despite a government program to mitigate the impact on consumers. Gas prices increased by nearly 36.9% during the month, and electricity prices increased by 16.9%. The Office for National Statistics said inflation would have been 13.8% had the government not introduced an energy price guarantee that limited the increase.

Wage growth lags behind the increase in prices, causing the most severe squeeze in living standards in memory and pressuring Prime Minister Rishi Sunak's government to take action. The inflation rate for low-income households was 11.9% compared to 10.5% for the richest households. On Thursday, Hunt is set to outline budget measures including how the government will support energy bills after the current package ends in April. He said his goal is to reduce debt while protecting the most vulnerable.

Forecast for the pound sterling against the US dollar today:

So far, the general trend of the GBP/USD pair is still bullish, and today's trading session is not normal for the pound. Details of the budget announcement of the new British government determine its fate until the end of the week's trading. I still prefer selling GBP/USD from every upside. The closest levels of resistance for the currency pair are currently 1.1965 and 1.2070, respectively. From the last level, I prefer selling without taking risks. On the other hand, according to the performance on the daily chart, testing the sterling-dollar pair at the support level of 1.1600 will be important for the general direction of the currency pair to turn bearish.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.