The performance of the price of the sterling currency pair against the US dollar, GBP/USD, last week was the most prominent for the bulls of the forex currency market. The currency pair jumped towards the 1.2030 resistance level, the highest for the currency pair in three months, and closed the week’s trading, stable around the 1.1880 level. By performance, financial markets have agreed to the autumn statement in Britain which promised a return to financial credibility, but the pound is increasingly proving to be reacting to global investor sentiment which should determine the direction in the near term.

Chancellor of the Exchequer Jeremy Hunt announced £55 billion in savings - roughly 2.0% of gross domestic product - as he sought to tighten fiscal policy to ensure the country's finances remained on a sustainable footing. Accordingly, Paul Dales, chief economist in the United Kingdom at Capital Economics, says that the development “seems to have been sufficient to satisfy the financial markets.” The bond market gave its nod as UK bonds remained well supported in the wake of the announcements. In fact, the yield these bonds paid traded lower than it did on the eve of ex-adviser Kwasi Quarting's mini-budget, suggesting that the risk premium from that event has largely been canceled out. Economist Simon French of Panmure Gordon says: “The benign financial markets reaction to the fall statement will be exactly what HMT wanted. Mission accomplished.”

Looking ahead, some analysts say markets will not welcome the prospect of new austerity being imposed on an already shrinking economy. Accordingly, Derek Halpenny, Head of Global Markets Research at MUFG, says: “We continue to expect the pound to continue to perform poorly against most of the ten non-dollar currencies in the future.” And “tightening fiscal policy in a recession weighs on the pound sterling.” However, most analysts say a return to a more sober and rational approach to UK fiscal policy in the aftermath of the Truss-Quarting debacle would be welcomed by the markets. Giles Coghlan, senior market analyst at HYCM, says: "There have been few surprises - a tight budget has already been priced in sterling, and bond markets tend to tighten as they work to reduce inflation."

Interpretation of the market's reaction to the fall statement was complicated by a negative day for global stock markets which showed an environment of weak investor confidence, creating conditions that usually hinder the pound's "high beta". Accordingly, Joe Manimbo, senior market analyst at Convera, says: “The pound sterling fell from its highest levels in three months against the US dollar with the decline in global markets.”

Recent market moves suggest that the pound's near-term direction may now depend more on global market conditions than developments in the UK, particularly given the Bank of England's December interest rate decision which is only due in December. However, some analysts are cautious about holding onto the pound, saying that unfavorable growth prospects in the UK will continue to be a headwind.

This is because one of the main fundamental drivers of exchange rates is relative economic performance, and thus a more pronounced British economic slowdown compared to other economies poses downside risks to the GBP. The Office for Budget Responsibility (OBR) released its latest set of economic forecasts and revealed that the UK economy is sliding into a recession that will last just over a year, with peak-to-trough GDP falling by 2%. Unemployment is now expected to rise by 505,000 from 3.5% to a peak of 4.9% in the third quarter of 2024. The tighter fiscal policy that comes with the £55 billion in savings announced by the Chancellor combines with the Bank of England's tight monetary policy that continues In raising interest rates, putting pressure on the British economy.

However, the Balance Sheet Office's forecasts are notably more optimistic about the economic outlook than those of the Bank of England. This is significant for Sterling, which fell after the Bank's October monetary policy report as an eight-quarter slump was expected.

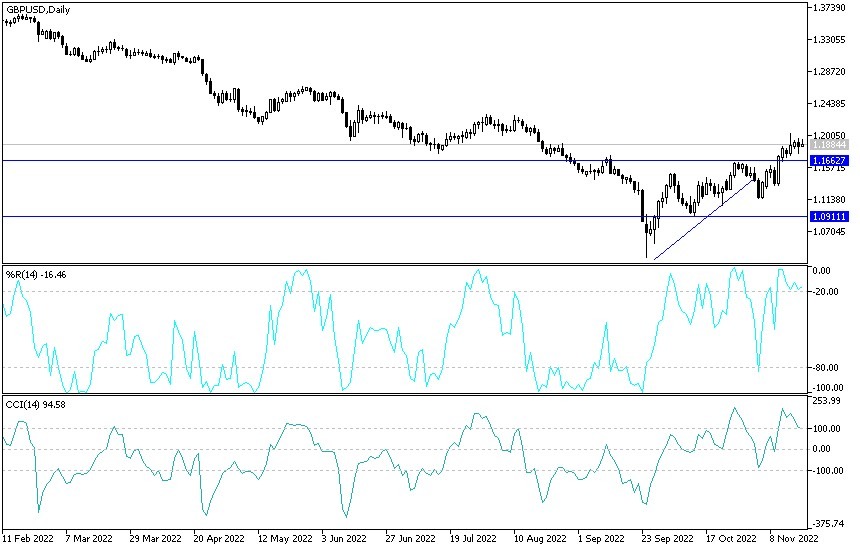

Technical forecasts for the GBP/USD pair:

- In the near term and according to the performance of the hourly chart, it appears that the GBP/USD currency pair has recently completed the breach of a descending channel from an ascending channel.

- This indicates an attempt by bears to control market sentiment in the short term.

- Therefore, the bears will be looking to extend the current decline towards 1.1831 or below to the support 1.1764.

- On the other hand, the bulls will be looking to pounce on profits around 1.1939 or higher at the 1.2030 resistance.

On the long run, and according to the performance on the daily chart, it appears that the GBP/USD is trading within a bullish channel formation. This indicates a significant bullish momentum in the long-term market sentiment. Therefore, the bulls will target long term profits around 1.2249 or higher at the resistance 1.2587. On the other hand, the bears will be looking to pounce on pullbacks around 1.1496 or below at 1.1136 support.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.