Sterling has bounced back from its previous sharp losses so far in the latest quarter, but it is likely to remain one of the biggest weak performers in the major currency complex into the new year 2023, according to Goldman Sachs' latest forecast. The rebound gains of the GBP/USD recently reached the 1.2030 resistance level, the highest for the currency pair in three months, and settled around 1.1890 at the time of writing.

All in all, the British pound rose against only four of its 19 counterparts in the G-20 this year and was carrying double losses against the same number, including the Russian ruble, the Mexican peso, the Brazilian real and the US dollar. Declines against the Swiss franc and Canadian dollar were also at high single-digit rates, although there were only two currencies against which the pound has actually managed to make notable gains including the Japanese yen and the Turkish lira.

All this despite a sharp rebound from record lows in late September when financial markets were protesting the government's previous budget policies. Commenting on the performance and impact factors, Michael Cahill, forex analyst at Goldman Sachs, said: “Thursday's budget marked the latest step in a major shift in fiscal policy, which significantly lowered the risk premium on British assets. However, we still expect Sterling to underperform in the near term as it absorbs the latest negative supply shock from energy prices.”

At the heart of this year's heavy losses for the pound sterling, the wholesale prices of mainly imported energy commodities have tripled as a result of attempts by the United Kingdom and Europe to move away from Russian oil and gas imports without other alternatives or sufficient investment in their development. This, combined with the rising cost of manufactured goods, is a large part of why import prices into the UK have risen so much faster and farther than exports, deepening the trade deficit in goods throughout the year while prompting a currency-negative deterioration in terms of trade.

“Britain is facing a severe shock in terms of trade capacity, but frictions related to Brexit are also affecting the trade balance and contributing to a very tight labor market,” Goldman Sachs analysts wrote in their forecasts for the pound sterling last year. They add: “The UK is the only G10 economy where activity remains below the pre-pandemic level, and our economists expect negative growth in 2023, while core inflation is exceptionally strong and shows limited signs of abating.”

However, it is not just the increase in import costs that has affected sterling, because the UK experienced one of the largest increases in inflation among the G10 economies as a result of these price changes, and this resulted in real or inflation-adjusted yields. British government bonds were offered well below zero. Another reason for the decline in inflation adjusted returns so far is the Bank of England (BoE) rate which has not kept up with the increase in inflation and this has been a headache for many analysts who have bearish views on the pound this year. The energy supply shock is unlikely to dissipate anytime soon, and it remains to be seen how quickly UK inflation will fall back to the BoE's 2% target, which is why the Goldman Sachs team expects another year of underperformance for the pound against several currencies.

However, for the US dollar and the euro, the outlook is not entirely bleak as the US dollar is expected to start depreciating in late 2023 while Europe and the European single currency remain in similar positions to the UK and the British pound. Goldman Sachs expects GBP/USD to drop to 1.07 over the coming months, but notes that the pair will end 2023 at 1.22 while the pound-to-euro price is seen dropping below 1.14 in spring 2023 before ending the year back above 1.16

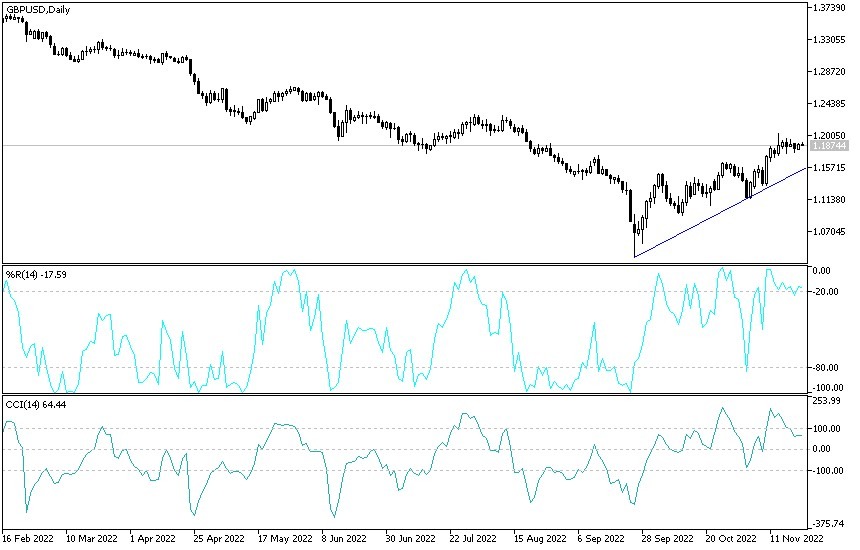

Sterling dollar forecast today:

According to the performance on the daily chart, the general trend of the GBP/USD pair remains, and for the bulls to continue controlling the trend, the psychological resistance 1.2000 must be tested again. At the same time, a trend break will occur if prices move towards the support levels 1.1730 and 1.1600, respectively. Today, the currency pair will be greatly affected by the reaction from the announcement of the PMI readings for the manufacturing and service sectors from Britain. From the United States of America, a package of economic data will be announced before the start of an American holiday that affects market liquidity, the most prominent of which are the number of durable goods orders, jobless claims. The reading of American consumer confidence, and the most prominent content of the minutes of the last meeting of the US Federal Reserve Bank.

Ready to trade our Forex technical analysis? Here are the best Forex brokers to choose from.