The recent downward pressures pushed the GBP/USD towards the 1.1393 support level at the time of writing. The performance is awaiting another important event after the US Federal Reserve's announcement, where the Bank of England will announce an update to its monetary policy. Whatever the announcement, it will not be at the same pace as the central bank's tightening policy. The American, who confirmed his intention to raise US interest rates until inflation is contained, and it seems that the positive US economic data. As mentioned before, gives the impetus to Jerome Powell and his colleagues to continue the tightening path despite the halt of some other global banks to reduce interest rates.

In a brief forex market research paper, analysts at HSBC say, "After signs of vertigo appear, sterling appears to be finding some equilibrium." The results come on the heels of an exceptionally volatile period for the British currency that culminated in its slide to all-time lows against the dollar on Monday, September 26. The declines came after financial markets reacted to tax cuts proposed by former Prime Minister Liz Truss that were to be funded by new borrowing, raising fears from investors who wondered whether the UK's debt situation would be fixed. The "mini-budget" disaster came at a time when markets were already grappling with the long-term and well-known structural issues in the UK, namely the budget deficit and the current account deficit.

Accordingly, Dominic Banning, head of forex research at HSBC, explains: “These imbalances require adjustment of the economy, interest rates and the currency, in order to find some form of balance.” The pound has since stabilized against the dollar, euro and other major currencies, leading investors to wonder if a bottom is in place now. “During previous periods of depreciation of the pound after major supply-side structural shocks to the British economy – in 2008 and 2016 – the currency fell to about 20% below its long-term fair value,” the analyst added. With sterling currently devaluing by 10%, a further 10% drop in sterling is reasonable.”

However, such a minimal adjustment is not necessarily likely, says the HSBC Forex Research Team and the analyst explains that this time may be different: in 2008 and 2016 UK interest rates were falling, but in 2022 they are rising, and it is evident in the rise of British bond yields. Looking ahead, HSBC says sterling is unlikely to rise and further declines are likely from here.

Sterling dollar forecast today:

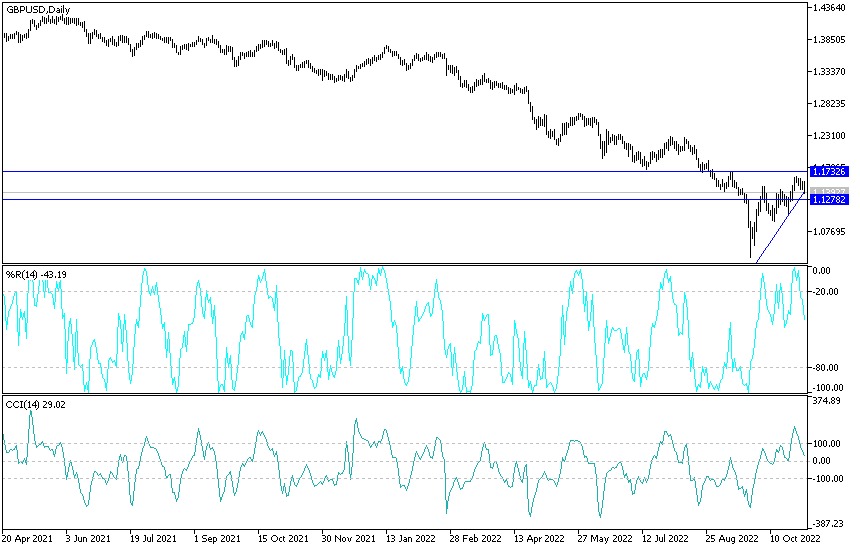

- According to the performance on the daily chart below, the movement of the GBP/USD currency pair towards the support level of 1.1330 will be important for more bears’ control of the trend.

- The level confirms the break of the recent upward trend, which was crowned by moving above the resistance 1.1600.

- We prefer to sell the GBP/USD from each ascending level.

As the factors of the strength of the US dollar continue and the pound is still facing the unknown. In general, the policy of the Bank of England today will be either supportive of a rebound higher or the completion and strengthening of the current opposite descending channel. The bears' closest targets are currently 1.1330 and 1.1240, respectively. On the other hand, the pair will not give up its bearish view without breaking the resistance 1.1600 again.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.