The end of the month period is known for currency volatility, and we're told that the end of November favors the euro against the pound and the dollar, although Tuesday morning sees some solid gains in the GBP currency.

- The euro exchange rates rose sharply at the beginning of this week's trading despite the lack of market-moving news, which prompted analysts to point out the hidden hand of month-end flows.

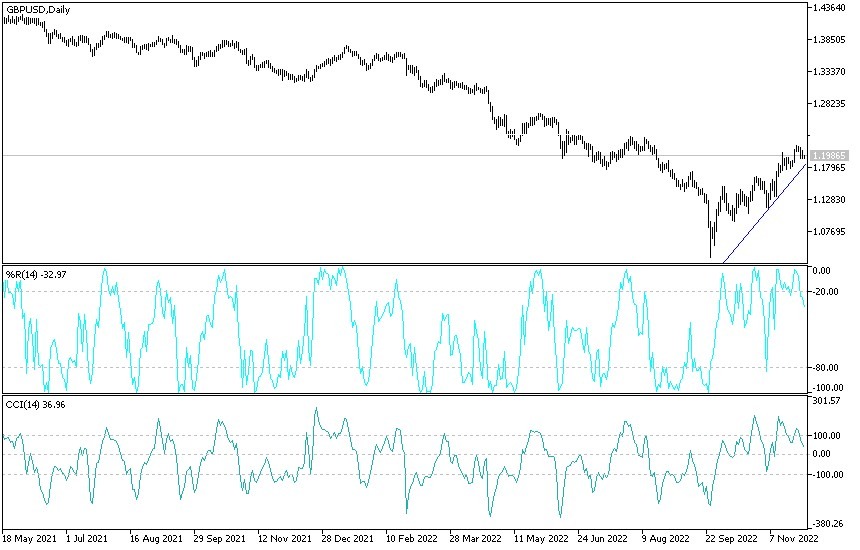

- In the case of the GBP/USD currency pair, it was sold, reaching the support level of 1.1940, and settling around the 1.1970 level at the time of writing the analysis.

- Its recent gains reached the resistance level 1.2153, its highest in more than three months.

Yesterday's market moves in favor of the British pound also appeared "out of nowhere", indicating a volatile day, but ultimately directionless. The inflows are expected to inject volatility into the market through Wednesday meaning those with imminent payments will need to be smart. For their part, researchers at Barclays say that currency dynamics are likely to be determined by end-of-month flows in the first half of the week, and end-of-month modeling indicates dollar selling, with a slight preference for buying sterling.

Crédit Agricole's model suggests a similar setup, although they see the Euro as a clear winner at the end of November. The end-of-month trading strategy of Crédit Agricole has achieved an annual return of 3.1% since 2012, with a rate of 72.3%. Portfolio managers will need to re-hedge their currency exposure, so that their currency standards are maintained. These FX rebalancing flows usually appear towards the end of the month, and usually have their greatest impact around 16:00 London time on the last trading day of the month. However, Barclays says the end-of-the-month phenomenon has been increasingly extended through the days leading up to the end of the month, which explains why there are large and unexpected moves on Monday.

The US dollar is widely cited by analysts watching the end of the month as a selling target due to the outperformance of US equity markets. The flows at the end of the month are largely a technical consideration and inject near-term volatility into the market and therefore do not correspond to any major shift in trend. In general, the pound rose against the dollar during November while recovering against the euro and it seems that it will end the month broadly unchanged. Much of this recovery is related to the ongoing recovery in global stock markets, to which the pound sterling is positively correlated.

The global picture is likely to be of greater consequence now that particular concerns about the UK have subsided since Prime Minister Rishi Sunak set the country's fiscal path back on track at Ten Downing Street. Global markets are still in a bearish trend with all indications that the recent recovery is a short-lived one and it won't be until next year when the cycle finally ends. If this is true, then the return of the dollar is possible.

Concerns about the UK's economic outlook will also keep investors wary of chasing a recovery in the British pound much higher, with many analysts saying the recovery is a technical repositioning in a market that was in a strong position against the British currency. UBS expects the GBP/USD exchange rate to return to 1.10 in the coming weeks before a more lasting recovery in 2023.

Forecast for the GBP/USD pair today:

There is no doubt that the GBP/USD price abandonment of the psychological resistance 1.2000 harms the bullish outlook for the currency pair. According to the performance on the daily chart below, testing the support levels 1.1880 and 1.1790 will be important to change the general direction of the currency pair to bearish. On the other hand, breaking the resistance 1.2090 again is important for the bulls' control. Today, the sterling-dollar pair is not awaiting important British data, and all focus will be on US data, led by the announcement of the US economic growth rate, the first US jobs data, ADP, and then statements at the end of the day by Federal Reserve Governor Jerome Powell.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.