During last week’s trading, the price of the pound sterling in the forex market suffered a sharp setback. The losses of the currency pair GBP/USD reached the 1.1147 support level. The sharp losses of the pound came after the Bank of England (BoE) indicated that the markets were wrong in expecting the bank interest rate is much higher than the level that was recently raised in November. At the end of the week's trading, the sterling-dollar pair bounced higher, reaching the resistance level of 1.1381, amid a noticeable decline in the US dollar following the announcement of the details of the US jobs report. The Pound rose against the Dollar on Friday but fell against many other currencies and comfortably remained the worst performer in the G-20 basket for the week due to losses incurred in the wake of Thursday's BoE decision.

Thursday's declines extended to nearly 2% in some sterling pairs and despite the Bank of England raising the bank rate by three quarters of a percentage point to a total of 3% in what was the biggest increase in more than three decades. The pound sank into losses after the Bank of England downgraded an already bleak outlook for the British economy and said the bank interest rate was unlikely to rise to levels many economists and financial markets had expected.

The new forecast showed how the earlier expected recession is now expected to last a full two years instead of the five-quarter period originally expected with the warning that a collapsing economy and low inflation could leave the Bank of England below its 2 per cent target by the end of 2025.

All of this came as a disappointment to the interest rate derivatives markets and any forecasters who had previously looked for a bank rate hike of more than five percent during the first half of next year even though it had little impact on expectations implied by prices or rates in the derivatives market. interest rates. Prices in the interest rate derivatives market had implied prior to the decision that the bank rate was expected to rise to 4.7% by June next year while that number had fallen to around 4.67% by Friday. This leaves markets still looking for further significant rate hikes with implications for the British Pound and the UK economy in the coming months.

Below, analysts and economists explain what it could be. Francesco Pesol, FX Analyst at ING “The bottom line is that the Bank of England is essentially closing the door for another 75 basis points, and we expect a 50 basis point rise in December.” The negative reaction in the pound rate was - in our view - due not only to the pessimistic re-pricing in interest rate expectations, but also the reconnection of forex dynamics to the somewhat worrisome domestic economic outlook, which has been clearly identified by the Bank of England. In fact, downside risks remain very high, and this week’s GDP numbers are sure to be watched closely: the consensus is currently around a 0.4% qoq contraction.

“Risks tilt towards a retest of 1.1000 in GBP/USD over the next few days, with payrolls potentially adding to the pressure on the pair,” the analyst added.

"Economic forecasts are that Britain is already in a recession, and that GDP will decline for eight consecutive quarters through mid-2024," said Stephan Koopman, FX analyst at Rabobank. And “forecasts should be taken with caution. Chancellor Hunt's £50 billion tax and spending plan has not been fully incorporated and the conductive future curve is outdated. And “these could be worth up to £50 billion, or 2% of GDP, but will be detailed on November 17.” Accordingly, “We expect a 50 basis point rise in December and a final interest rate of 4.75%. And that doubles the recession.”

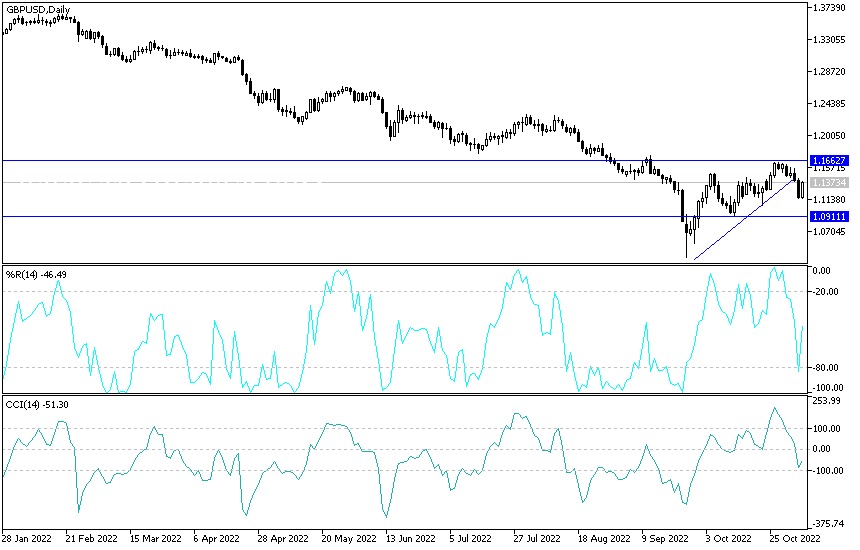

GBP/USD technical analysis:

- It appears that the GBP/USD is trading within an ascending channel formation.

- This indicates a significant short-term bullish bias in market sentiment.

- Therefore, the bulls will target short-term gains at around 1.1464 or higher at the 1.1568 resistance.

- On the other hand, the bears will look to pounce on potential pullbacks around 1.1287 or lower at 1.1186 support.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within the formation of an ascending channel. This indicates a slight long-term bullish momentum in the market sentiment. Therefore, the bulls will target long-term profits at around 1.1716 or higher at the 1.2092 resistance. On the other hand, the bears will target profits for a pullback at around 1.0991 or lower at 1.0629.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.