For two days in a row, GBP/USD has rebounded sharply from previous losses and may attempt to recover further in the coming days. The market may also be at risk of collapse again if Thursday's US inflation data lends itself to favor of the Fed's increasing policy tightening from. The GBP/USD price is stable around the resistance level 1.1535 at the time of writing the analysis.

The British pound was generally bought on a large scale while the US dollar was selectively sold against mainly European currencies. The US congressional elections on Tuesday and the release of US inflation data for October on Thursday are most important for how the dollar and British pound trade ends.

Commenting on this, Francesco Pesol, a forex analyst at ING says: “The biggest risk to the downside of the dollar is that the Republicans secure their control of the House and Senate, which implies a faltering administration unable to provide financial support in the event of an economic downturn.” "Congressional division (the House's control of Republicans) may be priced in mostly, and the repercussions for the dollar may be relatively limited," the analyst added.

Although Tuesday's elections will affect the US government spending outlook and will inevitably get a lot of attention in the market, it is Thursday's release of US inflation figures for October that will have the greatest scope to influence the Fed's policy outlook and thus the dollar outlook. On the outlook for the currency pair, Carol Kong, an expert at the Commonwealth Bank in Australia, says: “GBP/USD could fall this week if the US dollar strengthens as we expect. The Bank of England's (BoE) rally last week contrasted with hawkish FOMC Chairman Powell's comments, adding, "The difference between the Bank of England and the FOMC affects the pound."

Thursday's data will validate the Fed if it shows that US inflation is solidly flat around September levels or if it shows inflation picking up further during October as economists look to see slightly lower overall and core inflation rates. US inflation is even more significant for the Pound after comments last week from Bank of England Governor Andrew Bailey and Federal Reserve Chairman Jerome Powell, which spelled out an increasingly stark contrast between the two central banks' positions.

For his part, US Federal Reserve Chairman Powell warned last Wednesday that recent employment and inflation figures from the US argued in favor of a larger increase in interest rates than suggested in the September forecast, prompting economists and markets to revise their forecasts. The press conference in November prompted economists and markets to start touting the idea that US interest rates would rise above 5% in the second quarter of next year, just as the Bank of England sought to dissuade the market from the idea that the bank rate could rise from 3%, 4.7% over the same period.

For its part, the Bank of England indicated that it believes that its eight increases in the bank interest rate since last December are sufficient to ensure that inflation falls below the target level of 2% over the coming years, due in part to the impact of higher energy prices caused by the conflict in Ukraine.

Higher energy prices are expected to impact incomes and disrupt economic activity to a greater extent than in the US, a dynamic that is expected to emerge from Friday's UK GDP data for September and the third quarter. The consensus among economists is that GDP fell -0.4% in September and -0.5% for the third quarter overall, likely justifying the BoE's pessimistic forecast last week that the UK economy is on track for a two-year period of contraction.

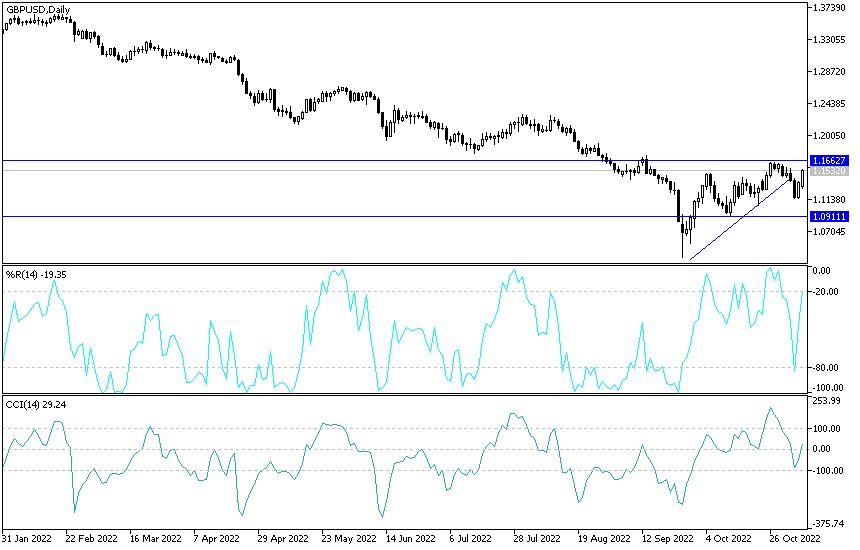

The analysis of the pound against the US dollar today:

- There is no doubt that the recent price movement of the GBP/USD currency pair is important to form a bullish channel that is relatively opposite to the general trend, which is still bearish.

- According to the performance on the daily chart below, a trend may be broken by moving towards the resistance levels 1.1660 and 1.1740, respectively.

- Selling from every bullish level will remain the most important performance for the time being, as the sterling is still facing pressure factors.

On the other hand, and over the same time period, the breach of the 1.1420 support level will be important for the bears to dominate again and to evaporate the current attempt to rebound to the top.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.