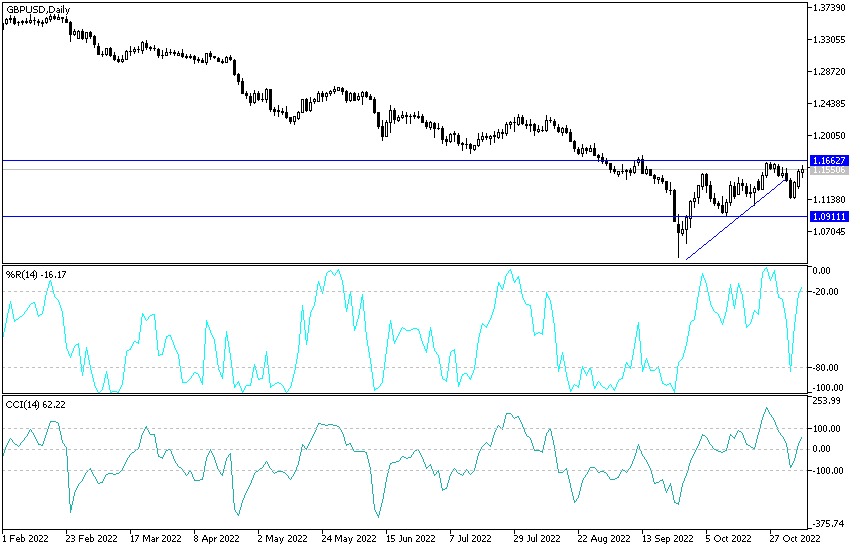

The performance of the British pound was softer yesterday after a strong recovery in the beginning of this week's trading. Price action indicated that the British currency is taking cues from global drivers in a week marked by a light domestic events calendar. However, analysts say the UK's domestic picture remains challenging, and any gains are likely to be short-term in nature. The recent rebound gains for the GBP/USD currency pair reached the 1.1600 resistance before settling around the 1.1530 level at the time of writing the analysis.

Recovering Losses

However, the top performing major currency was the British Pound Sterling on Monday, as global markets extended their recent rally, allowing the British currency to recover some of the losses incurred in the wake of last Thursday's Bank of England update. Provided the global mood music remains relatively upbeat, the Pound's recovery is likely to extend over the coming days. Commenting on the performance, Jeremy Stretch, analyst at CIBC Capital Markets said: "If risk continues to increase, we are ready to post modest gains for the pound."

Global stock markets were higher on Friday and into Monday as investors bet that China was laying the groundwork for an exit from its non-proliferation policy after a series of rumors. Such a development has the potential to unleash the faltering global economy and boost risk-sensitive currencies such as the British pound. Despite the weak markets and the Pound on Tuesday, losses were relatively small amid a relatively quiet overnight session in Asia.

Despite interest rates rising from floors last week, analysts still believe the potential for a pound rally will likely be limited. This is according to analysts at ING Bank.

For its part, the Bank of England raised interest rates by 75 basis points last Thursday but warned that rates do not need to rise as investors expected of 5.25% in the lead-up to the announcement. The bank warned that if interest rates rose to that much, the British economy would plunge into an eight-quarter recession. These dire warnings raised investor fears and contributed to a sharp drop in the valuation of the British pound. Accordingly, Michael Cahill, analyst at Goldman Sachs, says: “We continue to believe that the pound will perform poorly given the difficult external environment and lack of support from real rates, and we continue to expect further declines against both the euro and the dollar.”

Sam Lynton-Brown, currency analyst at BNP Paribas, says he expects sterling to weaken over the coming days. "Tight money means weak sterling," he added. He added that tighter fiscal policy would take effect, with Chancellor Jeremy Hunt set to set out £50 billion in savings in his autumn budget statement on November 17. Meanwhile, tight monetary policy - thanks to higher interest rates at the Bank of England - will come as the UK's growth outlook deteriorates.

Anticipation in US this week

With sterling reacting very strongly to global sentiment, what happens in the US this week could be a major deal. With markets engrossed in when the US Federal Reserve will end its next rate-raising cycle, US inflation data will be the main event of the week when it is released on Thursday. As a stronger-than-expected inflation reading (market looking for +8.0% y/y) will almost certainly support the US dollar and send stock markets lower and trigger an overall negative reaction in the GBP exchange rates.

But a weaker-than-expected number could have the opposite effect. Therefore, volatility is likely to be a feature of the second half of this week's trading.

GBP/USD forecast today:

- The continued weakness of the US dollar will continue to support a bullish move for the GBP/USD currency pair.

- The sterling gains will remain a target for selling as Britain still faces a bleak economic future and also the Bank of England's policy will not be on the same path as the US Federal Reserve.

- The closest targets for the bulls according to the current performance are the resistance levels 1.1620 and 1.1700, respectively.

- It is sufficient to push the technical indicators towards overbought levels.

On the other hand, according to the performance on the daily chart, the hopes of rising will evaporate if the sterling-dollar pair returns to the support levels of 1.1285. The currency pair is not awaiting important, influential data, and therefore investor sentiment will be the most influential on the currency pair.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.