Gold futures struggled to stay above $1,750 an ounce by the end of last week's trading, as the gold market was affected by the rise of the US dollar. While the XAU/USD gold price fell in 2022, the yellow metal outperformed many assets in the global financial markets.

- With expectations of the Federal Reserve easing the tightening cycle in the next year 2023, XAU/USD gold price gains last week.

- It is reaching the $1786 resistance level, the highest for gold price in three months.

- XAU/USD gold prices suffered a weekly loss of about 1.3%, in addition to their decline since the beginning of the year 2022 to date by about 4.3%.

In the same performance, silver prices, the sister commodity to gold, fell below $21 at the end of last week’s trading. The price of the white metal recorded a weekly decline of about 4%, raising its decline since the beginning of the year 2022 to date by 10.3%.

Overall, financial experts point out that the price of gold may have broken out of its downward trend that has plagued the precious metal for most of 2022, mainly because it retained most of its gains. In this regard, Robert Rowling, market analyst at Kinesis Money, said, “The price of gold is proving to be impressively resilient despite factual checking from Fed officials regarding the possibility of any pivot away from the bank’s rate hike chain.”

However, the main concern is that the US central bank may raise the federal funds rate to 7% to ensure that inflation is defeated. Right now, according to the Fed's dot-plot, the maximum policy rate for the Eccles Building will be 5%. According to the CME FedWatch Tool, most investors expect the Fed to raise interest rates by only 50 basis points at the FOMC meeting next month.

The gold market in general is sensitive to a rising interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

Other factors affecting the gold market

US Treasury yields were green across the board, with the benchmark 10-year yield rising 4.5 basis points to 3.818%. The one-year yield rose 5.3 basis points to 4.507%, while the 30-year note rose 3.9 basis points to 3.928%. The spread indicating recession between 2-year and 10-year yields has widened to about -70 basis points.

The US Dollar Index (DXY), which tracks the greenback's performance against a basket of major currencies, rose to 106.98, from an opening of 106.69. The index will record weekly gains of about 0.7%, in addition to its rise since the beginning of the year 2022 to date by about 12%. Generally, a stronger profit is bad for dollar-denominated commodities because it makes them more expensive for foreign investors to buy. As for other metals markets, copper futures fell to $3.6375 a pound. Platinum futures rose to $984.80 an ounce. Palladium futures fell 3.46%, to $1940.50 an ounce.

XAU/USD gold price forecast today:

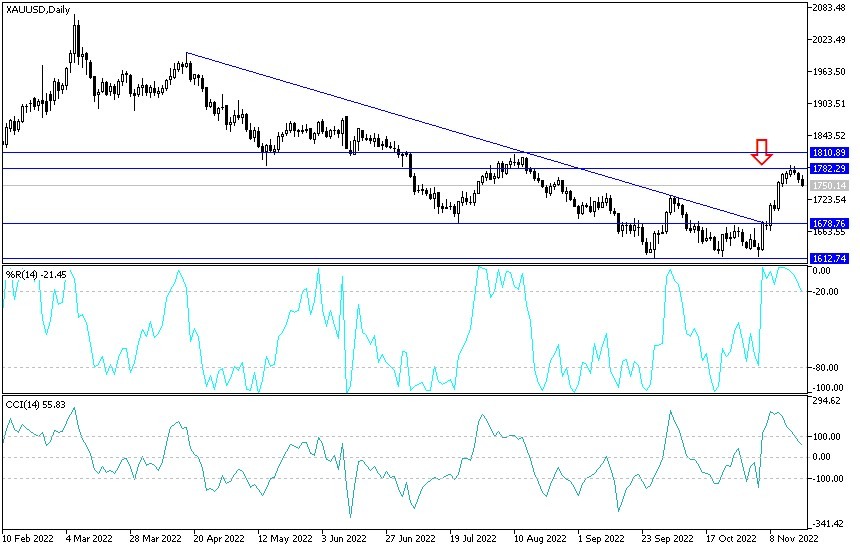

According to the performance on the daily chart below, the XAU/USD gold price is still in an upward trend, despite the recent selling operations. The gold price will not change without moving towards the support levels of $1733 and $1710, respectively. Currently the best selling price of gold from each upward level. On the upside, and as I mentioned before, the bulls' control will return strongly if the gold price stabilizes above the resistance at $1785 an ounce again. This in turn supports the movement of the gold price towards the next psychological resistance at $1800 an ounce.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.