Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best selling entry points

- Enable a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The TRY/USD continued to stabilize with the opening of trading of the week. The lira ignored any reports or operations that raise security concerns after the terrorist bombing that occurred yesterday in one of the historical neighborhoods in the Turkish capital, on Pedestrian Street in Istanbul, which resulted in the injury of 81 persons after a "terrorist" planted a bomb.

In this regard, Turkish Interior Minister Suleyman Soylu announced, early Monday morning, that the person behind the Istanbul attack that killed six people had been arrested. Where the Minister of the Interior revealed that the person responsible for the attack is from northern Syria and is believed to be affiliated with the Kurdistan Workers' Party (PKK).

Meanwhile, the Turkish lira was not affected by the rise of the US dollar against the major currencies at the beginning of this week, just as it did not benefit from the US currency's decline during the past week. The Turkish Central Bank continues to intervene directly and indirectly to control the price of the lira and work to prevent its decline against the dollar, especially in light of the stimulus policy pursued by the Turkish Central Bank, which puts pressure on the lira.

TRY/USD Technical Analysis

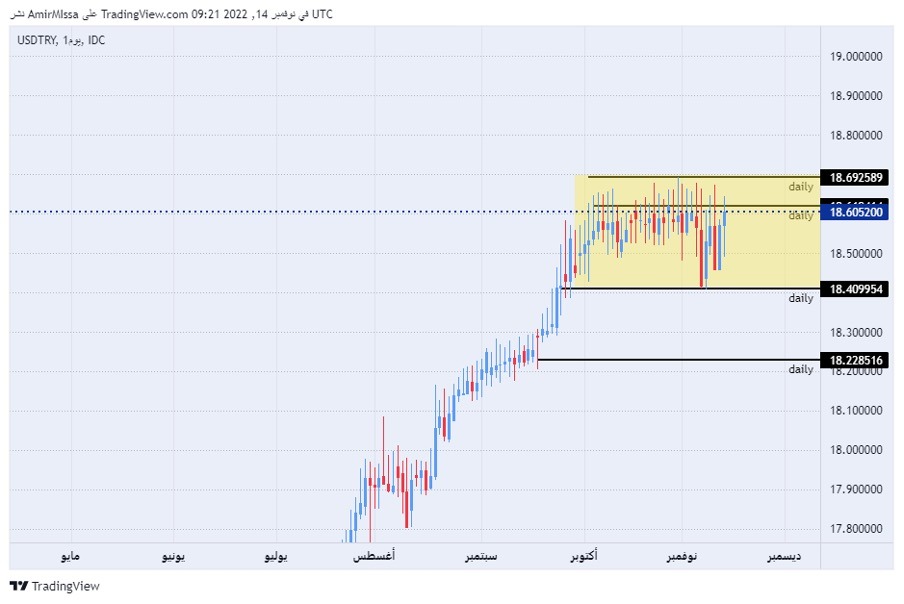

On the technical front, the Turkish lira's trading stabilized against the dollar, as it maintained trading within a narrow range that has been going on for several weeks, with slight movements recorded as the pair settled within the rectangle range shown on the attached chart.

The pair is trading the highest levels of support, which are concentrated at levels of 18.40 and 18.20, respectively. On the other hand, the lira is trading below the resistance levels of 18.70 as well as the psychological resistance at 19.00. The pair continued trading above the 50, 100 and 200 moving averages on the daily time frame, while the price is trading between these averages on the four-hour time frame as well as on the 50-minute time frame, in an indication of the divergence that the pair is recording at the moment.

Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.